So you’re looking to get into passive investing and you look for recommendations on where you should start. Almost every single book, guide, person will recommend to just dump all your money into a single ETF VDHG, however for whatever reason you might be looking for some alternatives to VDHG.

In this post I’m going to share with you some single ETF options to consider besides VDHG depending on your risk tolerance or industry preference. My names Michael and if we’re just meeting I started Passive Bets to introduce people to Active Passive investing and to share all the mistakes and lessons I’ve learned about investing and growing passive income streams.

Anyways lets get into it – heres a summary of the different types of alternatives Im going to cover and I’ll go through them in order of highest growth potential (riskiest) all the way to more conservative. And these will all be reasonably diversified, Australian domiciled (so no annoying tax work) and what I would consider alternatives for people who just want to invest in a single ETF and the first one is a like for like, a diversified high growth alternative.

US Market ETF – NDQ

Australian Market ETF – A200

Asian Market ETF – VAE

Emerging Market ETF – VGE

Whole World ETF – IWLD

(Almost) Identical ETF to VDHG – DHHF

Conservative Diversified ETF – VDBA

For each ETF I will cover I will provide an in-depth summary of the pros and cons and also dive-deep into the following:

- The Ticker

- What it invests in, geographically and industry sectors

- How many holdings

- Management fees

- Historical returns

- Dividends

- How it compares to VDHG in terms of historical returns, dividends and management fees, number of holdings,

- What scenario I think it would be a good alternative

Snapshot of VDHG

– 0.27% management fee

– 5.03%pa returned since inception but it has only been 2 years, the wholesale fund of VDHG that has been around for 20+ years has returned since inception 7.77%pa

– 10,000+ holdings

1. Technology focused – TECH

Global technology companies with a competitive moat.

- 35 holdings

- 0.45% fee

- 25.46%pa since inception

- 12 month distribution yield of 9.56%,

TECH is a good alternative to VDHG for someone who is extremely bullish on technology as a sector and wants an easy to way to diversify across great technology companies all around the world. The index that TECH tracks only includes companies that it considers to have a significant competitive advantage over its competitors or a “MOAT”, they might be in established industries with large barriers to entry (like manufacturing microchips).

Obviously quite a bit of risk having exposure to only a single sector of the market. If you are bullish on tech, check out my post on some great technology ETF options on the ASX.

2. US markets – NDQ

Top 100 non financial companies by market cap on the US Nasdaq stock exchange.

- 100 holdings

- 0.48% fee

- 20.75%pa since inception

- 12 month distribution yield of 1.9%

NDQ is a great pick and a good alternative to VDHG for someone who believes in the market leading companies of the world (most of which are listed on the NDQ and have the largest market caps). You get a lot of exposure to technology companies or companies that are extremely innovative and in sectors under-represented in the Aussie sharemarket. For examples its largest holdings are Apple, Microsoft and Amazon.

3. Australian focused – A200

Top 200 companies by market cap on the Australian ASX.

- 200 holdings

- 0.07%pa fee

- return since inception 2.67% but not a fair comparison since it only launched in 2018 and has had 2 large market drops in that time. The index it tracks has returned 5.79%pa over the last 10 years

- 12 month distribution yield of 4.2% 79% franked.

The best thing about A200 is the low management fee and the franked dividend. At 0.07%pa its almost free and the dividend is typically quite stable over the long term. A good pick and a good alternative to VDHG if you want to diversify among the top companies in Australia. But be a bit careful because if you also work in Australia, anything that affects us here locally will hit you twice as hard.

4. Asian markets – VAE

Diversified holdings across Asian companies excluding Japan, Australian and New Zealand.

- 1269 holdings

- 0.4% fee

- 8.2%pa since inception

- equity yield 2.83%

VAE is a suitable ETF for buy and hold investors seeking long-term capital growth, international diversification and who have a higher tolerance for the risks associated with developing Asian economies. About half its holdings are in China which is important to be aware of. But it’s a nice option, and a good alternative to VDHG as you get huge diversification across a bunch of Asian countries which are developing at fast rates and (importantly) it lets you diversify out of Australia.

5. Emerging markets – VGE

VGE aims to track all companies no matter their size that are listed on emerging markets.

- 5034 holdings

- 0.48% fee

- 5.64%pa since inception

- equity yield 3.03%

This is an extremely diversified ETF with allocations in China, India, Brazil, South Africa, Russia, the list goes on, basically every country that isn’t a developed country. The VGE ETF aims to get exposure to all listed companies in each of these markets. VGE is a suitable option thats great for those of you to choose if you think there will be a much bigger shift towards emerging economies and want a single ETF to get really diversified exposure.

6. Higher growth (riskier) – IWLD

Like the name suggests the IWLD ETF aims to get whole world exposure to large, medium and small-cap companies.

- actually holds 4 ETFs IVV, IEFA, IJR, XIC, with approximate holdings of 4000 companies across these 4 ETFs

- 0.09%pa fee

- 10.95%pa since inception

- 12 month yield of 2.49%

IWLD is probably the most diversified ETF I am showing you here with exposure to small, medium and large cap companies in developed markets (no emerging markets). IWLD gives you total market coverage across these countries but mainly the USA with 64% exposure, great option with extremely low management fees.

7. VDHG ETF Clone – DHHF

DHHF has an extremely similar makeup to VDHG (direct competitor), 90% growth assets and 10% bonds. A bit of a case of Vanguard vs BetaShares here, similar to VAS vs A200.

- 8000+ holdings

- management fee 0.26%

- no relevant performance metrics or yield yet (only launched in Dec 2019), however we can comfortably assume DHHF will have extremely similar returns to VDHG over the long term

For all intents and purposes, this is more or less a direct copy and competitor to VDHG but with a 1 bp (0.01% p.a) lower management fee. Expect the performance and dividends of this to be almost identical to VDHG but there is always the unknown of how long the fund will stick around whereas with Vanguard, they have never closed a fund after opening one and they have an extremely long track record.

DHHF is a good alternative to VDHG for someone who just wants something extremely similar to VDHG but with (slightly) lower fees.

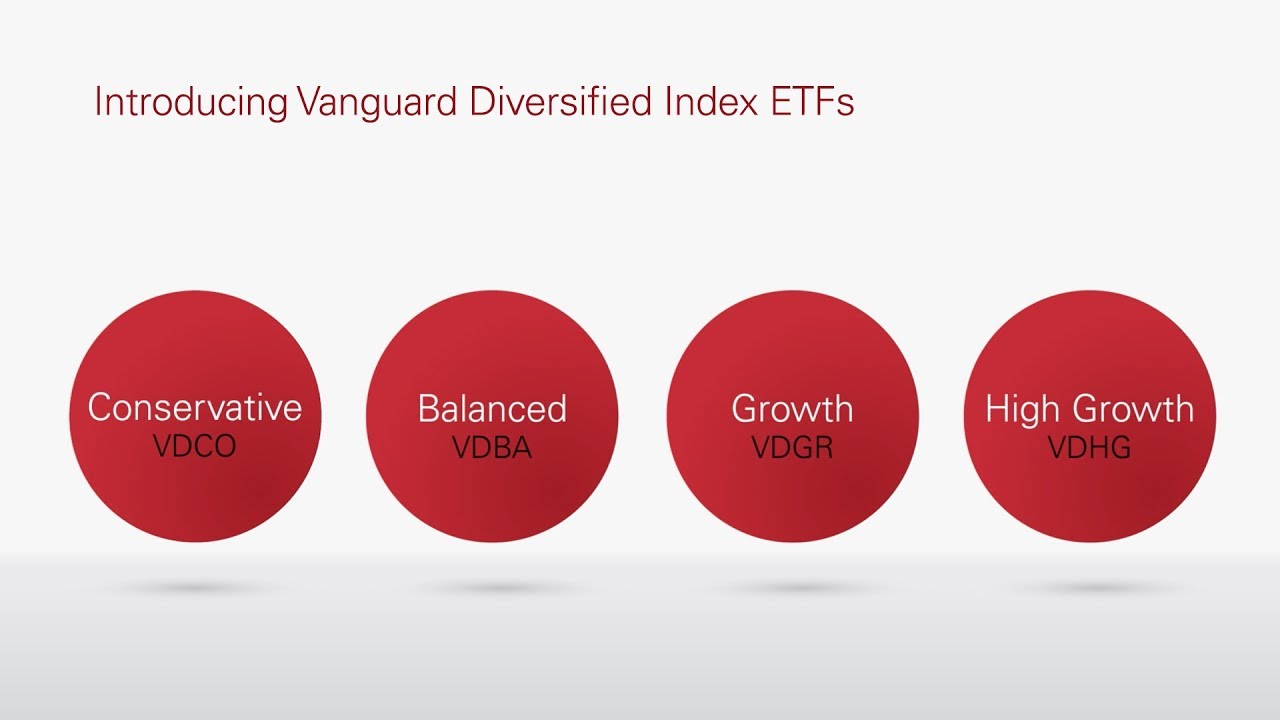

8. Conservative – VDBA

This last option of VDBA is in fact identical in terms of the holdings exposure to VDHG but with smaller weightings in equities, with a 50/50 weighting between securities and bonds.

- 10,000+ holdings

- management fee 0.27%

- approximately 7-8% p.a returned over the long term with a larger weighting of 4-5% returned in distributions rather than equity growth

Same management fee as VDHG and its great for someone who wants a diversified option like VDHG that is a bit more conservative over the long term, interestingly over the long term since 2002 almost 20 years this has returned 7.39%pa

So there you have it, that was 8 alternatives to VDHG at varying levels of sector and demographic exposure. Let me know in the comments if you think theres a good alternative I missed or if you have any questions. Thanks for reading see you in the next one.

What about purely VGS or a VGS/VAS blend as an alternative to VDHG? (Higher US/higher tech mix, good FSI exposure and some healthy exposure to resources.)

Thanks

Hey Nic, I like that a lot, old faithful 2 fund Vanguard portfolio 🙂

Hi Michael

For 65+ folks what’s the better mix, can one split up investments say 50% of their money in VDBA and 50% VDHG

What is a nice formula to use for pensioners living in Australia , using pearler

Thank you !