In this post we’re going to cover what is pretty much my favourite way to invest and I would even go so far as to say that this is the best safest and easiest long-term investment strategy out there for most people and also, this is the investment strategy that requires very little work no skill needed and still has some of the best returns out there. Even more surprising what if I told you that this investment outperforms 99% of individual investors and almost 90% of hedge funds and this is something you can do with about 20 minutes of your time and yes I know that you know what I’m already talking about here based on the title of the post but let’s drum up a little bit of suspense because I’m talking about Exchange Traded Funds or ETFs, and in particular low cost index funds.

So let’s go over exactly what an ETF is, how it works, and how you can set this up yourself in a matter of minutes to profit long term. I’m going to show you how even on an average wage of $60,000 a year, if you invest just $500 a month or around 10% of your pay. If you start at 20 years old by the time you retire at 65 you can have over $2 million dollars.

I truly believe in the ETF investing strategy long term as this is the strategy I use myself and I also have a lot of data and research that backs up everything that I talk about.

What is an Exchange Traded Fund (ETF)

So first of all let’s start here, what exactly is an ETF, well it stands for Exchange Traded Fund, and an ETF is really just a simple way for you invest in a whole group of companies by only needing to purchase a single share, rather than needing to purchase individual shares in every single one of those companies. And there are ETFs that do this across 10 companies all the way to literally thousands, that’s right you can buy a single share in an ETF and own a tiny little piece of thousands of different companies all around the world.

Here’s an example, imagine if I owned a thousand apartment buildings and they’re each worth one thousand dollars. I go to you and I say I will sell you one of my buildings for $1000, that would almost be like the equivalent of you going and buying one stock of one individual company. But the problem here is that now you only have one apartment building or in the case of shares, only one company and what happens if that company doesn’t do very well in the short term or even worse goes bankrupt! How do you prevent something like this? Well here’s the solution to this, imagine in my previous example where I gave you a scenario where instead of investing a thousand dollars and you buy one of my thousand apartment buildings imagine if you could invest $1,000 and then you get 0.1% of everything that I own so you’re a small percentage owner in all of my apartment buildings this way you get an averaged return based off everything that I own this is basically an ETF.

For example you can own all of the top 200 publicly traded companies here in Australia for the low price of just about $101 (A200). This way you’re not just buying one stock in one company but instead you’re buying literally all of them and also with ETFs you can do this with pretty much any market out there if you want to own a small portion of pretty much every single US stock out there well you can do that from the low price of just $234 (VTS), or you could invest in companies all around the world for the low price of just $36 (IWLD). And it doesn’t stop there because there are ETFs for pretty much every single market or industry out there. If you wanted to just invest in bonds well there’s an ETF (VGB) for that, or if you want to just invest in tech companies (TECH), even if you want to invest in property, you could even become a property investor without all the hassles of actually managing a property through a property based ETF, also known as a (real estate investment trust) REIT.

But that then begs the question how exactly do these ETF managers choose which companies will go into an ETF.

Passive ETFs vs Active ETFs

ETFs come in two overarching types, passively managed or actively managed, and depending on whether an ETF is passive or active will determine how investments are allocated within an ETF.

So for a passively managed ETF to decide which companies or stocks to invest in, they follow this thing called an index. And this index is essentially a set of rules or instructions telling the ETF which companies it should own. For example the A200 ETF I mentioned earlier which invests in the top 200 companies in Australia, well it does this because it follows the “Solative Australia 200 Index”. And that index has instructions to track the top 200 most valuable companies on the Australian Stock Exchange. This is very simple to do and it doesn’t require a person to manage the ETF, as it is passively following the instructions given to it by the index it is tracking. Because of this, it usually means that passively managed ETFs will have low fees.

On the other hand with actively managed ETFs, well they don’t track an index. And the way in which stock or companies are selected to be part of the ETF, is by a human or a fund manager. Because of this active management, these types of ETFs will usually have higher fees, and like I said previously, over the long term over 90% of fund managers actually underperform a passive index. So with an active ETF, not only are you not even guaranteed to get a higher return than a passive ETF (in fact you most likely won’t), but you are guaranteed in 99% of cases to be paying higher fees every single year.

Why do passive index ETFs make great investments?

Now you’re probably wondering what exactly makes passive index ETFs such a good investment?

All right so let’s start here, the biggest advantage with passive ETFs is the one I already touched on and is that they have very low fees. That’s because these indexes are very simple to put together, they’re very simple to manage, there isn’t much overhead, and all of those savings get passed on to you. What’s awesome is that for this low fee your entire ETF portfolio automatically gets balanced and adjusted over time without you doing any work.

The second advantage with doing this, is that for most investors out there they will make more money investing in an ETF than they would investing in individual stocks on their own. Several studies have shown that over 90% of portfolio managers could not outperform the market index over a 15 year period. And keep in mind that these are people who are the brightest in their field who have gone to Ivy League schools with a really deep understanding of economics and finance who do this full-time daily and not even they can outperform just the market index.

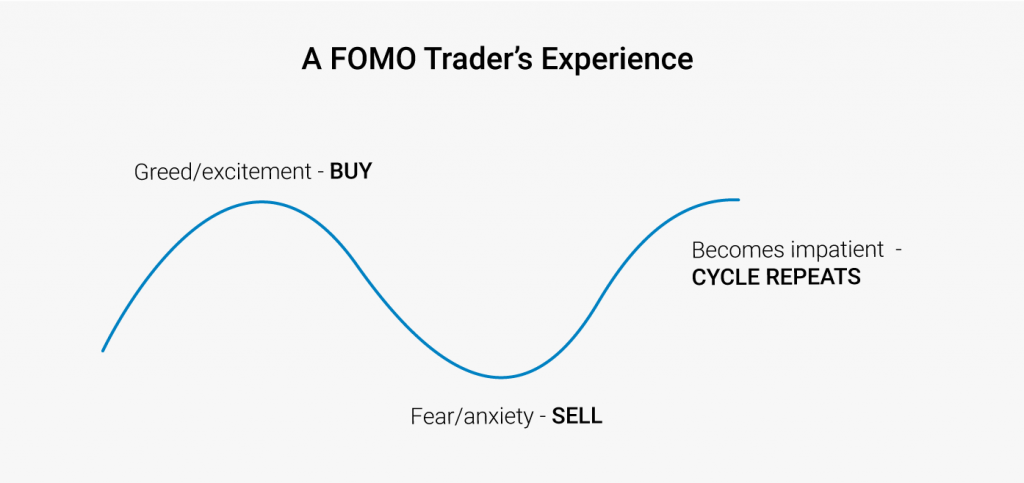

And those figures are so much worse for the average individual investor. A big reason for that is that many investors tend to trade emotionally and panic when the market drops also known as panic selling and then they try to time the market, or they jump in a stock as it’s going up for fear of missing out (FOMO investing) and it’s because of that, is why they usually end up getting much lower than average returns.

Also in a 2017 interview, the legend Warren Buffett went so far as to say that index funds make the best retirement sense “practically all the time”. Really, attempting to pick times to buy and sell stocks is a mistake for 99% of the population. Warren Buffett even went so far as to bet a collection of hedge fund managers $1,000,000 that they couldn’t beat the market over a ten-year period and outperform an index fund, and he won. A standard low cost Vanguard ETF beat some of the most highly paid (and expensive) fund managers.

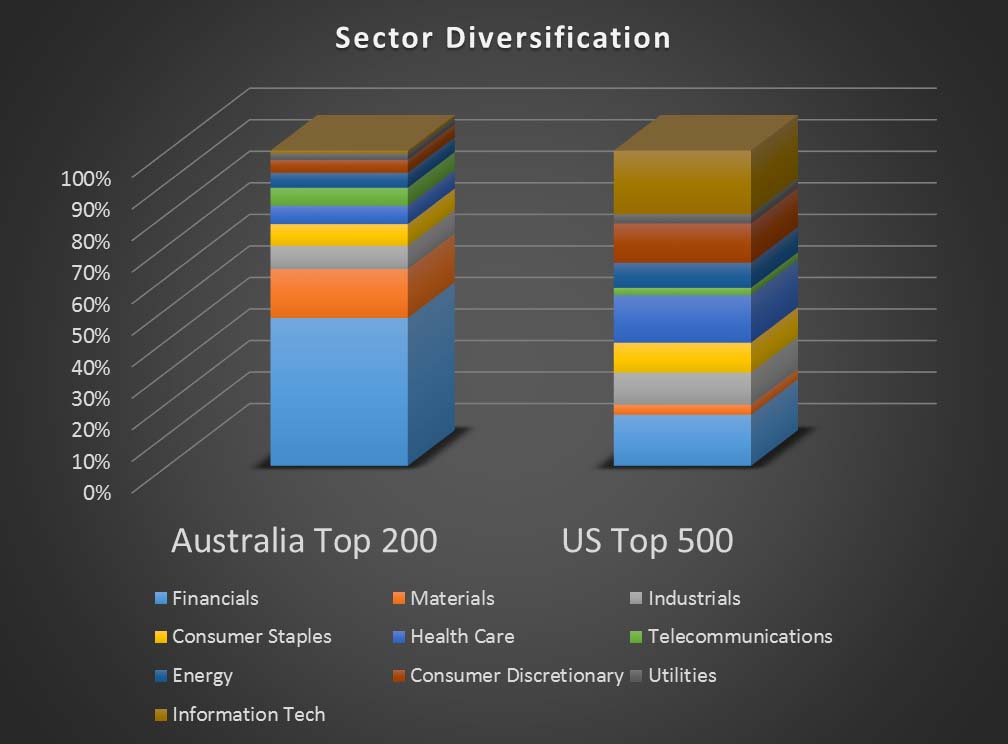

The third advantage of going and buying ETFs is to have a huge amount of diversification. Like even if you have 10 individual stocks in your stock portfolio if one of those goes down and fails you can end up losing a lot of money. On the other hand if you go and buy the entire ASX 200 index fund, then you have 200 different stocks and different companies that contribute to your overall return. So even if one of those fails it doesn’t really matter because you have 199 others to boost you up.

This means that having a few individual companies go up or down in the markets in the short term won’t really affect your overall return because you’re betting long term that the market will rise overall as a whole. Also doing this as an investor will give you a lot more market stability because let’s be real most people can’t handle the market volatility and as soon as they see it go down they panic and they freak out and they sell it and then they see it going back up and they buy back in because it’s going back up now. Then they have literally done the worst thing in investing, which is to buy high and sell low. That’s why investing in passive ETFs solves most of those issues.

Fourth, the reason I invest using ETFs is because it takes no time to do and it’s easy, I just love the simplicity of it. Once you’ve decided what kind of exposure you want to get and which ETFs you want to use, it’s just a matter of topping up each month or whatever time period you want and buying more.

I also fully acknowledge that I am NOT a stock market expert and that I don’t think I would be successful in trying to buy and sell individual stocks to return a profit over the long term. Nor do I want to invest the time to try, and probably fail given that even 90% of hedge fund managers, the most skilled people in the world cannot consistently beat the market long-term. Instead I will just invest passively in ETFs and sit back, relax and focus my time on other areas. I’ll be honest with you, when I first started investing I tried picking individual stocks. Not only was it ultimately very unsuccessful but it is also so much more stressful, having to constantly check share prices, monitor ASX announcements. Passive ETFs are literally just a buy it and forget about it mentality.

How to invest in an ETF

So now you know that passive ETF investing is a good strategy but to actually get started with investing in ETFs, well you need to actually do this via the stock market. Hence the name Exchange Traded Fund. And in order to start investing via the stock market you need to sign up for a stock brokerage account. There are lots of different stock brokers out there at the moment.

But I’ll make this easy for you, currently the cheapest stock broker and simplest to use for new Aussie investors (as it doesn’t allow you to invest in anything outside of the ASX yet), is a company called SelfWealth. They have trades for a fixed cost of $9.50 per trade, most other brokers will charge you at least $15-$20 and then usually a % of the amount you’re trading on top of that. Well not SelfWealth it’s always just a fixed cost no matter how little or how much you are buying and as a bonus if you sign up with a referral code you will get 5 free trades. Here is a link to my referral code so if you sign up using that your first 5 trades will be free.

Which ETFs should I start with?

Now that you have a brokerage account and have access to the stock market, all you need to do is deposit your funds into your account and then decide which ETFs to buy. Now there isn’t a single best way to do this but one of the most popular strategies is using this thing called the 3 fund portfolio. The 3-fund portfolio is a portfolio modelled on the idea of maximizing simplicity, diversification, and flexibility. The simplicity allows you to understand and manage your own investments, the diversification helps you lower the risk of any single asset’s under performance becoming catastrophic, and the flexibility allows you to set an allocation that suits your circumstances and financial stage of life.

The three-fund portfolio, which is often recommended due its low fees and simplicity consists of:

● A domestic “total market” stock index fund;

● An international “total market” stock index fund; and

● A “total market” bond index fund

With just 3 funds, you can

» Have a globally diversified equities portfolio;

» Control your level of market risk with your stock to bond allocation; and

» Control your currency risk with your domestic to international allocation,

3 fund portfolio strategy and be utilised throughout the world and the Australian version is using:

There are alternative funds to use for each one of these categories, for example you could substitute A200 instead of VAS or IWLD instead of VGS, however the all Vanguard strategy will never be a bad option and I could go on for hours talking about different alternatives or different ETFs to use. The most important thing is that you choose an allocation of ETFs that 1) are passively tracking an index (therefore have low fees), 2) suitable for your circumstances, for example if you are young you may not need any bond exposure and it might make sense for now, to have nothing allocated to bonds. Currently I don’t have any bond exposure, but that will change as I get older. And finally 3) pick an allocation of ETFs that are diversified, for example don’t only get ETFs with Australian companies as then you are overexposed to just one country. Which is not ideal in case something negative that only affects Australia was to occur.

This 3 fund portfolio gives you broad diversification at a very cheap cost and is going to give you consistent market returns over the long term, which will honestly be likely to be much better than just about almost anything else that you can do in your own and not only that but because you’re investing in multiple asset classes you have three almost uncorrelated markets that you have your money into so that way if something happens to one you have two others that would balance that out.

However if even this sounds a bit too difficult there is an even simpler option of just going with a single ultra diversified fund, which includes, domestic, international and bond exposure all rolled into 1 single ETF. There’s definitely a few alternatives out there again for this but personally I would only recommend 2 that again wouldn’t ever really be a bad option for the majority of people. These would be VDHG from Vanguard and DHHF from BetaShares. These are ETFs that would be appropriate to use for someone who just wants a single ETF to invest in, however like I said depending on your age, risk tolerance and a whole bunch of factors, there are definitely other options to consider in this single ETF category as well. Check out my post I’ve done on 8 alternatives to VDHG where I go over these.

Don’t try to time the market

So now you know how to actually get started with ETF investing in Australia, however like I mentioned it must be a long term strategy, and as part of a long term investing strategy you need to hold and keep buying more units of the ETFs over time. This is currently my strategy and every month I purchase more units of ETFs because I totally recognize the benefit of the diversification and the stability of doing this long-term for a relatively low cost.

But then what about when it comes to market timing since we’re nearing all-time highs again does this mean it’s a bad time to invest or is this a good time to invest. This is probably one of the most common questions from anyone looking to get involved with investing in the stock market and thankfully this is a relatively easy one to answer. The truth is that no one can accurately and consistently predict what the market is going to be doing in the short term it wasn’t even three months ago that the market was crashing and everyone was saying the bull run was over and that everyone should sell everything and hold cash and then buy back in at the dip and then like three months later we’ve almost entirely recovered and everyone is taking back what they said and like oh well no the market isn’t really crashing it’s it’s it’s actually I never said that.

So with that said there have been dozens if not hundreds of studies that have been done on this that proved that time in the market beats timing the market in the majority of situations and a study done by Charles Schwab in 2012 found that between 1926 and 2011, a 20 year holding period across broad market ETFs NEVER produced a negative return.

No one can predict what the market is going to be doing in the short term so why even try instead I just invest whenever I have the money with the expectation of holding it one to two decades and I will come out ahead now in terms of actually doing this it is really just as simple as going to opening a stock market brokerage account and keep buying the same investments over and over and over again and expect to grow your wealth at the same rate as the entire stock market. And that’s pretty much it that’s all you have to do it’s really easy it’s really basic it’s really simple and that strategy will be perfect for 99% of individual investors out there for a very low cost I mean it’s really just there’s nothing not to like about this.

I love you Youtube channel and your website. It is fantastic info and great research. You are the best ever. Just wonder whether you are comfortable to share your portfolio? Recently, Asia came down so much due to Chinese regulation. What do you think? Good chance to add more or hold on?

Thanks Cynthia! Really appreciate the kind words!