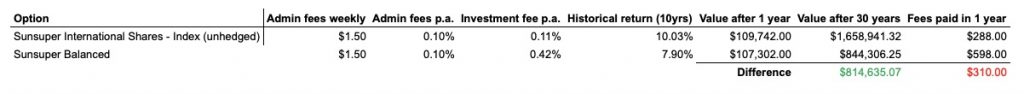

Superannuation can be an extremely confusing investment vehicle, especially for one that is compulsory for all Australians. It is kind of amazing the difference you can achieve over 30 years by simply choosing a high-growth super option instead of the default “Balanced” option. For example if you took $100,000 30 years ago and put it in a high-growth option instead of a “Balanced” option you would have $1.6M, over $800,000 more then if you left it in the default “Balanced” option.

I recently re-allocated my superannuation investment towards a high growth superannuation option, in order to achieve higher expected returns over the long term whilst at the same time still ensuring low fees.

In this post I’ll go through my evaluation process and show you some things to consider when assessing superannuation options. And of course I’ll provide you some high-growth options to consider for your superannuation.

As always the ideas presented in all my posts are general in nature and I am not a financial advisor. So remember to do your own research.

High Growth – Risk vs Return (and why default “balanced” superannuation investments suck for young people)

When you sign up for any superannuation fund they will often suggest a default investment option into their “balanced” fund which usually has something like a 70/30 allocation between growth assets (equities) and defensive assets (bonds). However this typically isn’t suitable for someone seeking higher returns on a 20-30 year time horizon with their super.

Why?

Because the higher the risk you take, the higher the expected return (the point on the diagonal line below), but it also increases the range of potential outcomes. There’s no guarantee that your actual return will be your expected return. To get this higher expected return, you face the risk of any of the range of possible returns for the risk you’re taking.

As a young person with a long time horizon this isn’t actually as bad as it sounds. You actually want to look for investment options with higher risk volatility, as over the long term these have higher expected returns. Yes its true in the short term you may hit those lower lows but you might also hit those higher highs and given that superannuation forces you to wait until you’re 65 (or older) before you can access it, over the long term you should expect to be closer to the mean expected return.

This is why I would suggest avoiding any defensive asset allocations in your super for young people with a long time horizon before accessing their super.

Fees

My next problem with most default “balanced” superannuation options is that they typically have relatively high fees and that’s because they are “actively managed”, which means they have expensive fund managers managing the portfolio. Most of which rarely ever beat the returns on the total market index over the long term. However what is guaranteed from active investment options is their consistently higher fees when compared to an indexed superannuation option.

Take Sunsuper for example. Their default “Balanced” option has total fees of 0.65% p.a. vs their “Australian Shares – Index” option which has just 0.09% p.a. On a superannuation size of $100,000 that is $650 a year vs $90 a year. Which would be okay if they had higher returns over the long term but remember their balanced options typically have 30% defensive assets so that’s going to be almost impossible.

There’s also a separate fee that you will need to pay which is an administration fee. This is a fee charged by the superannuation company to essentially “manage” your superannuation and it will differ depending on the company. I’ll go into those in more detail later in the comparisons.

Diversification

My final problem with most super fund default investment options is that they typically have heavy weightings in both Australian Shares and Australian Property. I won’t go into why I think the Australian share market is generally not set up to perform very well over the next 20-30 years. But for someone who works and relies on their income in Australia, I don’t think it’s wise to also have your superannuation investments coupled so tightly with the Australian market as well.

If for example the Australian economy in isolation starts tanking, it’s highly likely your job may also be at risk. So not only have you lost your job but your superannuation would also be dropping as well. Whereas if your super was more geographically diversified you would be more protected from any Australian specific downturns.

Comparisons

The comparisons I will provide for high-growth superannuation investment options in Australia will be based on the following assumptions:

- $100,000 investment base

- Historical return will be based over the last 10 years unless otherwise stated

- No insurance options

- Suitability for someone with at least 20-30 years before they would access their super and have an appetite for higher risk/higher returns

- I’m only going to compare passive indexed options

I will now go through what I consider good high-growth superannuation options with low fees, suitable for long term investing for young Australians. At the end I will provide a comparison table showing returns and fees over the long term

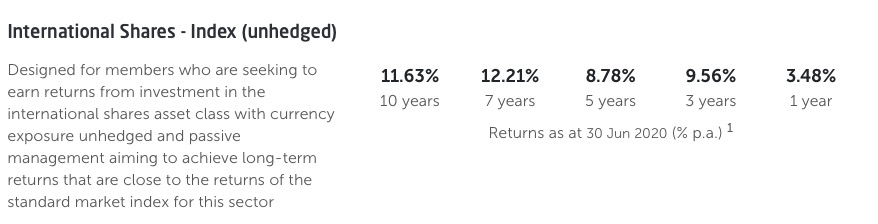

Sunsuper International Shares – Index (unhedged)

- Administration fee $1.50 per week + 0.10% p.a.

- Investment fees of 0.11% p.a.

- Historical return of 10.03% p.a.

The index that this is tracking is MSCI World ex-Australia Investable Market Index (IMI) in $A (unhedged). Which is more or less International equities minus Australia. Unhedged meaning you will be exposed to currency fluctuations as well. In layman terms this is; good if AUD goes down, bad if AUD goes up in comparison to the USD.

Hostplus International Shares – Indexed

- Administration fee $1.50 per week

- Investment fees of 0.09% p.a.

- Historical return of 13.00% p.a.

The Hostplus option tracks the MSCI World ex-Australia Index (net dividends reinvested) and has even lower fees.

Rest Overseas Shares – Indexed

- Administration fee $1.30 per week + 0.10% p.a.

- Investment fees of 0.00% p.a.

- Historical return of 12.35% p.a.

Perform in line with the MSCI World ex-Australia ex-Tobacco Net Dividends Reinvested Index (unhedged in AUD) (before tax) over all time periods. Interestingly Rest doesn’t have any investment fees but they make up for it with tacking on a per annum admin fee.

First State Super International Equities

- Administration fee $1.00 per week + 0.15% p.a.

- Investment fees of 0.09% p.a.

- Historical return of 12.35% p.a.

Tracks the MSCI World ex-Australia ex-Tobacco Net Dividends Reinvested Index (unhedged in AUD) (before tax) over all time periods. This is the same index that Rest is tracking in their international indexed option as well.

In summary these are 4 very similar high-growth superannuation options all tracking very similar high-growth indexes. I wouldn’t pay too much attention to the historical returns as we all know that past performance doesn’t predict future performance. And given they are all tracking very similar indexes I would focus more on the fees paid in a year, with both Hostplus and Rest performing slightly better than Sunsuper and First State Super in this regard.

One thing to note is that whilst Rest’s fees are slightly lower on a $100,000 balance over 1 year, since their administration fee makeup is more weighted towards % p.a, on higher balances Hostplus may actually be cheaper fee wise. So do your own analysis here.

I hope this helped you as it surely helped me. If you’re also interested in some high-growth passive investment options to invest in outside of super, check out this post. Please leave a comment if you have any questions or queries.

When seeking instant relief, explore our options to acquire effective treatments [URL=https://driverstestingmi.com/item/nizagara/]lowest price for nizagara[/URL] .

Looking for a reliable source to purchase your medication? buy zoloft online cheap offers an effortless way to get your prescriptions with just a few clicks.

When seeking to improve your lifestyle and wellness, consider exploring https://heavenlyhappyhour.com/product/nizagara/ . Available on the internet, it presents a option for men facing medical conditions.

For those seeking relief from upset stomach, find a wide range of options by deciding to [URL=https://drgranelli.com/drugs/asthalin/]asthalin generic[/URL] . Guarantee your comfort now with a simple buy.