What are the signs of a stock market crash?

How to recognise a looming stock market crash

In this post we’re going to debunk some stock market myths and look at the best ways to prepare for a stock market crash with our best, most trustworthy friend, data. Okay, so if we look at the financial markets today and the news surrounding it, you could definitely say it’s a turbulent time with a lot of unknowns. There’s talks of hyper inflation, the ongoing Evergrande debt crisis, trade wars between the west and China, and then people like Robert Kiyosaki the Author of Rich Dad Poor Dad saying that the “The biggest crash in world history” will hit in October.

Three market timing scenarios (and their wildly different results)

Don’t worry about timing the market

However I don’t want to focus on whether the stock market is going to crash or not, as the reality is, nobody knows. But more importantly, in the long run it really doesn’t matter. Let me explain.

We receive comments almost every day asking if it’s the right time to invest given that the market is at an all time high. It’s a a valid concern, especially if you are starting out. So I want to dive right in and analyse the data across three different scenarios to see how we’d fare trying to time the market.

First, if we’re the worst market timers in existence, second, if we’re omniscient and all seeing and are able to correctly predict every market bottom and invest at that time, and third, if we don’t try to time the market at all and just consistency invest over time using the dollar cost averaging strategy.

In all three of these scenarios I’m assuming that you’re able to save $200 a month for 40 years to use for investing into the S&P 500, a total of $96,000 invested ($200 x 40 x 12). Full credit to reddit user /u/jerschneid who crunched all the numbers for this analysis.

Terrible Timing Timmy ($663,594)

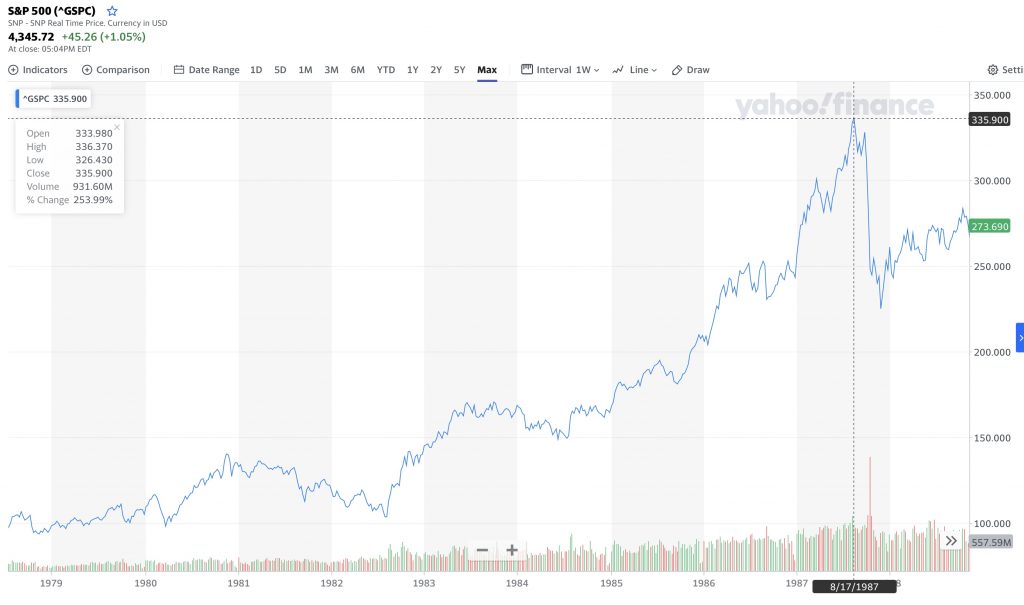

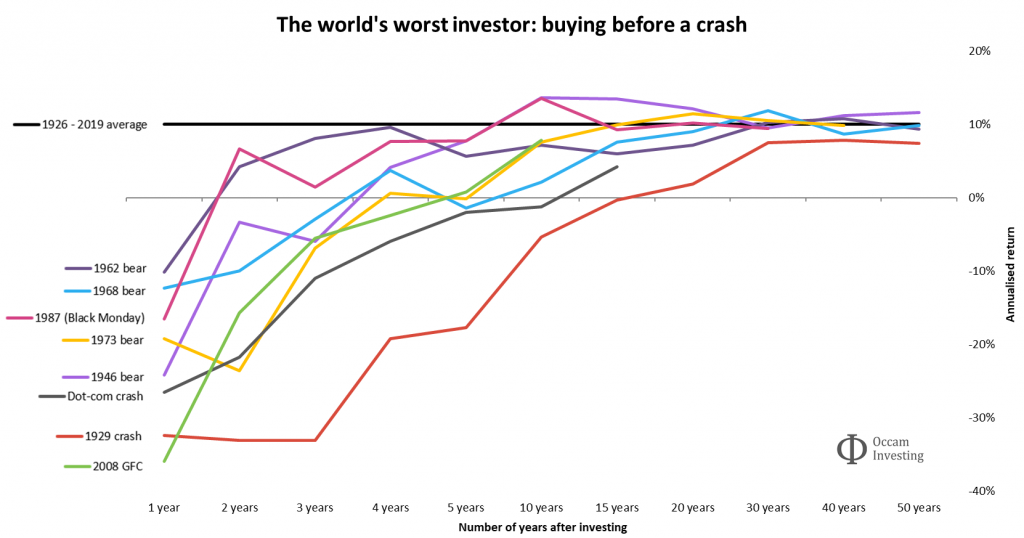

First up, imagine you are Timmy the unluckiest investor on Earth. You’ve saved $200 a month getting 3% interest for 8 years, watching the stock market sky rocket during the 1980’s. Only to finally put his money in at the absolute market peak in 1987, right before Black Monday and the resulting 33% crash.

But he never sold, and instead started saving his cash again, only to do the same at the next three market peaks. Each time he invested the full amount of his saved cash only to watch the market crash immediately after. Most recently he put all his money in the day before the 2007 financial crisis. He’s been saving cash ever since waiting for the next market peak. Timmy truly had the most terrible market timing.

However, even with this truly terrible market timing, Timmy didn’t end up doing that badly in the end. His $96,000 that he saved and invested over the last 40 years is now worth $663,594. Even though he invested at every single market peak over the past 40 years, this result is thanks to the power of buying and holding. Since he never sold, his investment always recovered and flourished as the market inevitably recovered far surpassing his original (terrible) entry points. This just goes to show that buying high can still turn out okay, as long as you don’t sell.

Brilliant Bailey ($956,838)

Now for this next example, imagine you are the complete opposite to Timmy, you are the world’s best market timer and only ever buy stocks at the absolute bottom of a recent market crash. Welcome to the world of Bailey.

She also saved her money in a savings account earning 3% interest, but she correctly predicted the exact bottom of each of the four crashes and invested all of her saved cash on those days. Once invested, she also held her index fund while saving up for the next market crash. It can’t be overstated, how hard it is to predict the bottom of a market. In 1990 with war breaking out in the Middle East, Bailey decided to dump all her cash in when the market was only down 19%. But in 2007, the market dropped 19% and she didn’t jump in until it fell all the way down to a 56% drop, again perfectly predicting the exact moment it had no further to fall and dumped in all of her cash just in time for the recovery.

For this impossibly perfect market timing, Bailey was rewarded. Her $96,000 of savings had grown to $956,838 after 40 years. It’s certainly an improvement, but interesting to note that when comparing the absolute worst market timing versus the absolute best, the difference is only a 44% gain. Both Bailey and Timmy have the vast majority of their growth thanks to buying and holding a low cost index fund. Again the important thing is that they both did not panic sell and held over a long period of time.

Slow and Steady Subscriber ($1,386,429)

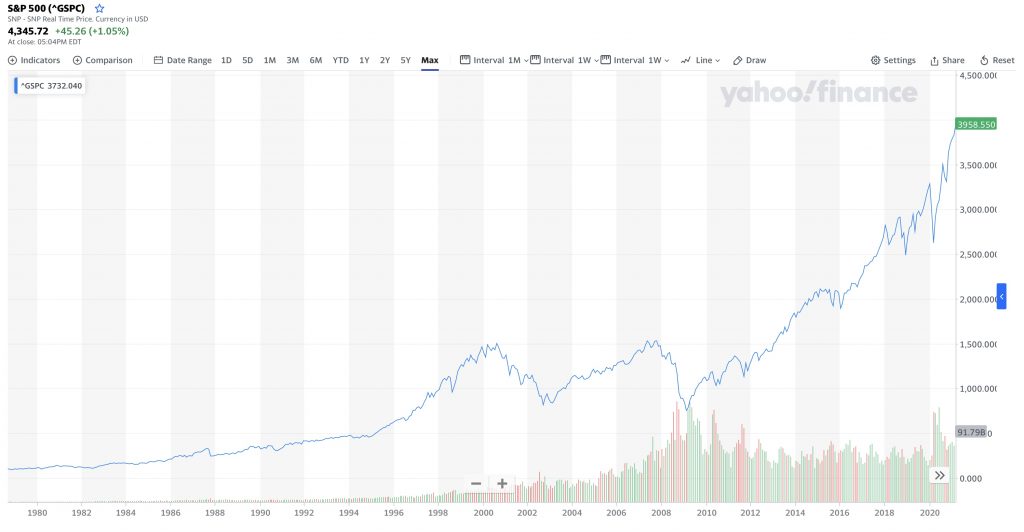

Now, as a WalletLab subscriber whose read all our posts where we talk about the benefits of consistent long term investing, I know you guys aren’t like Timmy and Bailey. You don’t try to “buy the dip”, watch stock prices or listen to analysts saying that the market is about to crash. Well for all of you slow and steady subscribers, imagine that in 1979, the same starting point as everyone else. All you did was set up a $200 per month auto investment in an S&P 500 index fund.

Each month your account would automatically invest $200 more in the index fund at whatever the current price happened to be. This meant that you invested at every market peak and every market bottom. Your money never sat in a savings account earning only 3%.

Well, after the 40 years, when you finally decide to have a look at your portfolio value. All of you subscribers would be pleasantly surprised with what you find. The slow and steady approach had grown your nest egg to $1,386,429. This huge gain, even though you didn’t have Bailey’s impossibly perfect ability to know the bottom of the market, the slow and steady dollar cost averaging strategy beat Bailey by more than $400,000.

So if you aren’t subscribed yet, what are you waiting for! (Newsletter subscription at bottom of page)

Recap of different investment timing strategies

- Amount Saved/Invested: $96,000 each

- If you left your money in the savings account: $185,212

- Investment: Buy and hold an S&P 500 index fund

- Timmy (worst market timer): $663,594

- Bailey (best market timer): $956,838

- Subscriber (automated monthly investments): $1,386,429

So if you’re worried about the market being at an all time high (which it definitely might be), remember that even if you only buy at the all time highs right before the crashes, you’ll still be substantially better off than if you left your money on the sidelines in a standard savings account, as long as you don’t sell! But the best thing to do by far, is to consistently add to your investments over time, regardless of the current price, as this will even perform better than the world’s best market timer! The simplest way to do this will be through using an automated investing tool. I use Pearler as its simple with some really great features to help making long term investing way easier, check out my full review on Pearler if you want to learn more.

Don’t invest more than you can afford to lose

Evaluate your current risk level

Now that you know that timing the market over the long run isn’t actually a big deal, the next thing you should do to prepare yourself for a potential stock market crash, is to evaluate your current risk level. What I mean by this is, that you should only ever invest what you can afford to lose. As with any investment there is always the possibility it goes to 0. If you’re investing in a broad market ETF, this chance is in all likelihood close to 0, and if we ever see the S&P 500 go to zero, well, we’ve got some really big problems, way bigger than our own personal stock portfolio.

But what is possible and of course the point of this article, are various stock market crashes over the term of your investing, these could range anywhere from 10% drops, to well over 50%. This is why I usually say that any investments you make into the stock market, should only be with money that you probably won’t need to access for at least 10 years. Let me explain why.

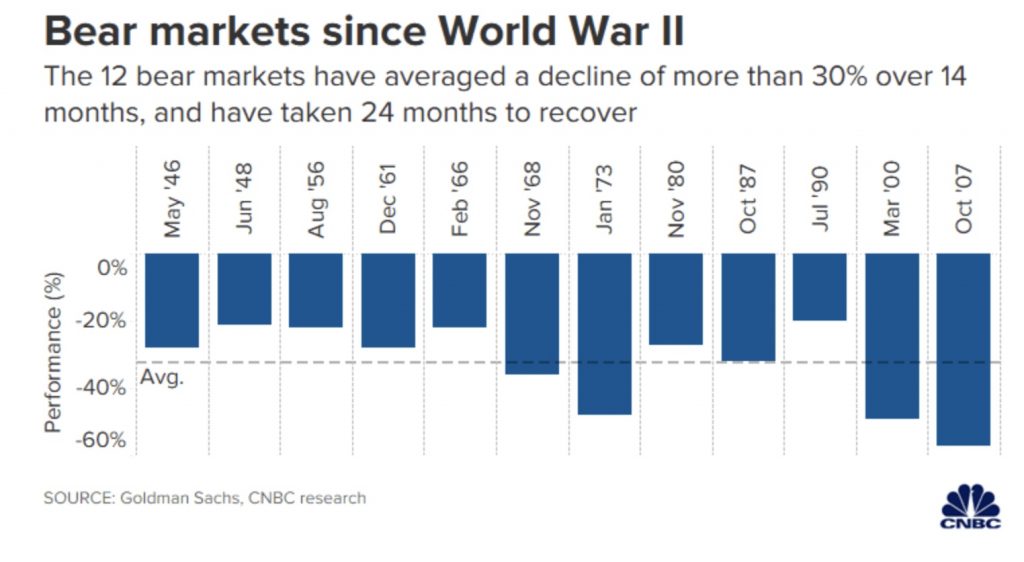

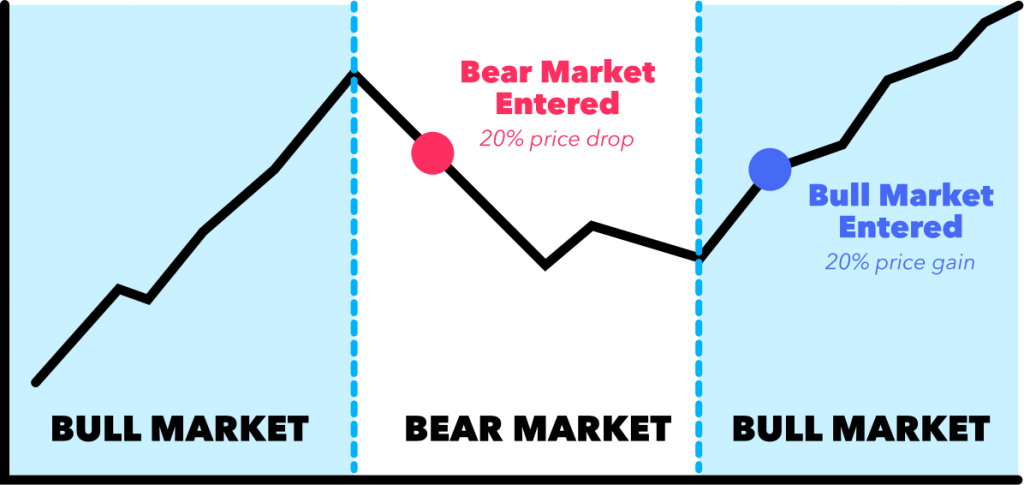

There has been 12 bear markets between World War II and 2007 with an average decline of 32.5%. With a bear market being defined as a drop of more than 20% from the 52 week high.

One of the longest market crashes was in October 2007, where we saw the market decline for almost 2 years until March 2009. The market dropped 56% and then took more than four years to recover, only to reach its previous high. This is why I think you should only be investing with money you don’t need for at least 10 years, as it could potentially take 6-7 years for you to get back to breakeven in a worst case scenario of investing right before a super long market crash. And then you would probably want to stay in the market at least a bit longer to get a return.

Important to note though that on average bear markets have only lasted 14.5 months and usually take around two years to recover. So it’s often only around 3 years to get back to breakeven if you invest just before a market crash.

The stock market is an odds game, where you will win over the long run

But if you’re a numbers guy like me and need a bit more convincing, well another really interesting data point I’ve found is the number of stock market “up” days vs. the number of “down” days.

In the 20 years between 1996 and 2016 there was a total of 5,035 trading days and in 2,683 days of those the S&P 500 had a positive trading day, as in it closed higher than it did the trading day prior. That means that the the percentage of stock market up days from 1996 – 2016 was 53.29% and the percentage of stock market down days was 46.71%.

Which looks great, but we should also take a look at the returns as it doesn’t matter if you win more often if your losses are way bigger than your wins. The total return % came out to be 2200.69% on the up days and -2043.19% on the down days. Which worked out to be an average daily gain of 0.82% on the up days and an average daily loss of -0.87% on the down days.

Which finally works out to be an average return over the 20 years of 7.88% p.a. So whilst the odds are slightly better than a coin flip, over the long run this small edge will compound into massive returns. Its the same concept of being the “house” at the casino, in most games the “house” will only have a small edge of just over 50%. But because of the law of large numbers it “guarantees” stable long-term results for the averages of random events. For example, while a casino may lose money in a single spin of the roulette wheel, its earnings will tend towards a predictable percentage over a large number of spins. Which spawns the saying “the house always wins”.

Always prepare for the worst

Have an emergency fund

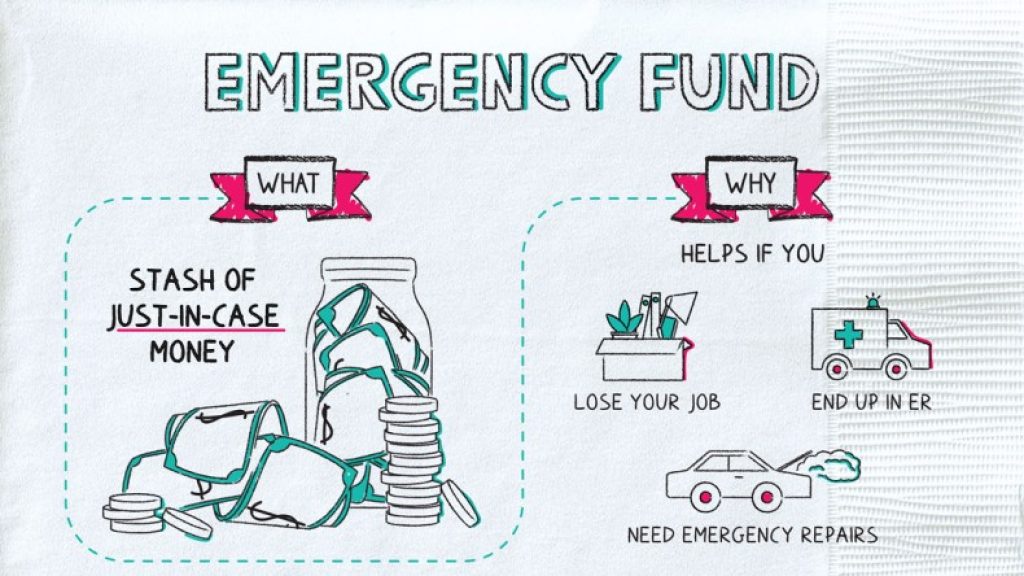

Which brings us to our next point on how to prepare for a market crash, and this is to always have an emergency fund set aside.

Now for those who don’t know an emergency fund is really just the money you set aside to only be used in case of – you guessed it, an emergency, where you have no other place to turn. And ideally the size of this emergency fund should be equivalent to three to six months worth of your living expenses and kept easily accessible for obviously, emergencies.

Now having this type of three to six month emergency funds means you’re not gonna have to rely on credit cards to pay your way through any unexpected event. You won’t have to sell your stocks or other investments to pay for it at a time where they’ve declined in value and it’s not a good time to sell. And you won’t have to take on any high interest rate debt anytime something happens so in a way having this money sitting on the sidelines could end up saving you a lot of money and almost acting as though it’s an insurance if anything is to happen. So if you don’t already have an emergency fund then, this is definitely something I would start preparing for before a stock market crash.

So the obvious question will be “but why don’t I would just invest the money instead and get a much higher 2% return and put it in the stock market” And certainly you could go and do that but my rationale is that typically emergencies happen on short notice when you most need the money and if a stock market crash happens, by the time you need your money your investments have declined 20% in value, which at that point I have a feeling you would have wished you had just kept it in a savings account instead.

I often hear a lot of people recommend that you “bolster” up your emergency fund if you think the stock market is due for a crash, so that you will have “extra” funds to invest with if the market crashes. Personally I think this is pretty counter intuitive and goes against a long term investing mindset. As we’ve already established its basically impossible to predict a market crash, so you might have this extra money on the sidelines getting almost no return for what could be a really long time. And this effectively would turn you into a “market timer”, when you could have just been investing this extra money consistently over time.

I prefer to just keep 6 months of living expenses in a savings account, and I don’t change this value, even if I “think” a stock market crash is imminent.

Don’t put all your eggs in one basket

Make sure you are diversified

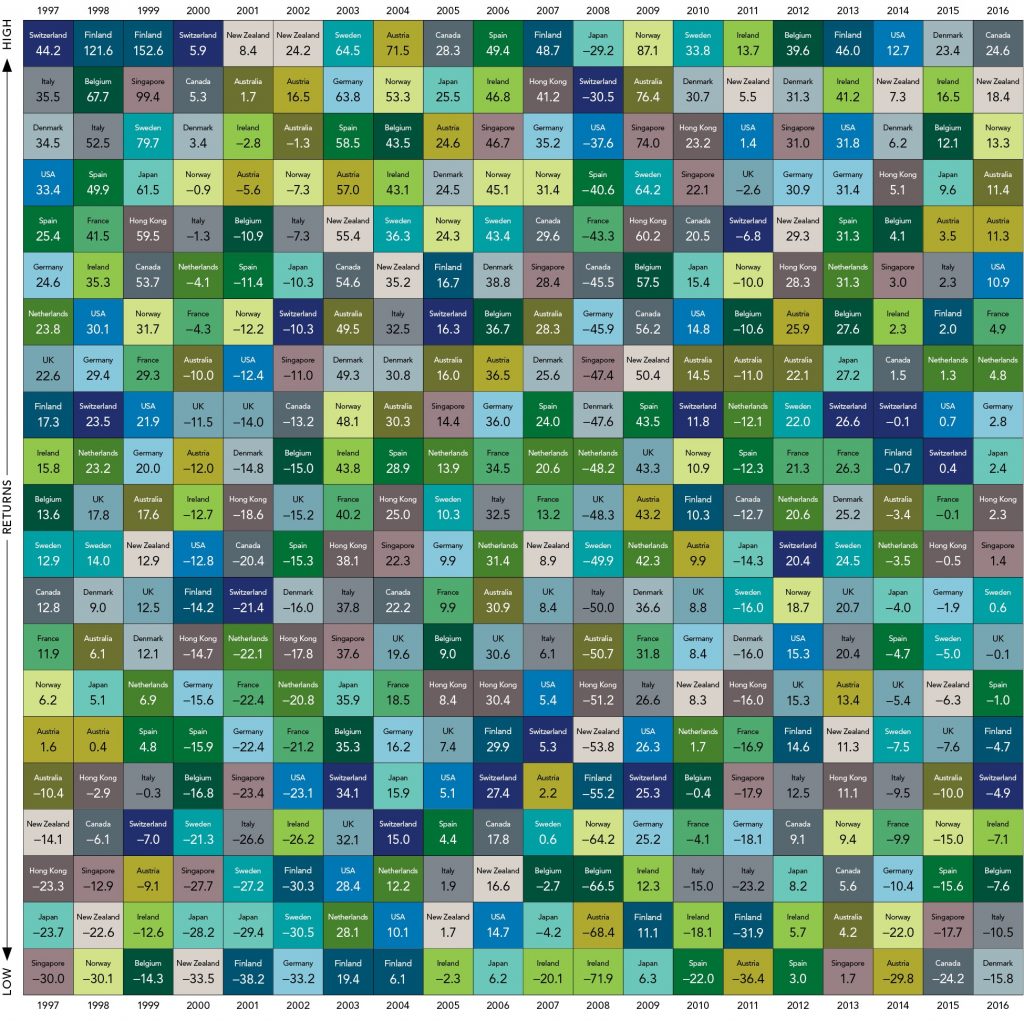

In terms of being well prepared for a market crash, one of the most important things you can do is look at your portfolio and see if you are well diversified. Sometimes a market crash might actually only effect a certain area of the market, or have a larger effect in a particular industry or sector. This effect is only magnified if you’re invested in individual companies!

To combat this, I would ensure that your investment portfolio is well diversified across both industries and countries. This could be as simple as using a single globally diversified ETF like DHHF or VDHG, or a combination of ETFs to achieve a similar result.

Do not panic sell if the stock market crashes

What to do if the stock market crashes

Now imagine we’ve done everything on this list and we’re really prepared for a stock market crash and then finally we find ourselves right in the middle of one, like the most recent COVID stock market crash. What should we do now?

This is where its extremely important we go back to the example I went through at the beginning of the article with Timmy, Bailey and you Subscribers! This is where we will make our long term returns and where we need to keep doing as we have been, continuing to invest regularly with our committed level of regular investing amounts. Its tempting to increase the amount we normally invest with to get “juicy” returns, but again, we really don’t know where the bottom is, so even if we find ourselves in a bear market, we might still have a ways to go to the true bottom.

On the flip side its also very tempting to sell and “minimise” your losses, but this is again probably one of the worst things to do, as again, you never know when the bottom is, and how will you decide when to buy back into the market? Remember the examples from earlier, where even the best market timing was outperformed by the regular automated investing. I heard countless anecdotes from people around me who switched their super to Cash during the start of Covid, most of which, weren’t able to predict the swift recovery, and lost a lot of their retirement savings because of this decision.

The best thing to do during a stock market crash is to stay the course and continue on your automated investing schedule and remember the law of large numbers, where over the long run you, like the casino, will always come out on top.