Should you invest in real estate or the stock market, this is the age old question that I think everyone has considered at one point in their life. Given that it’s probably one of the biggest financial decisions you’ll make, we have unpacked and analysed the numbers of both options in detail to truly show which one is better.

The Australian property market is worth over 7.7 trillion dollars, and to put things in perspective the Superannuation industry is worth 3.3 trillion dollars and the Australian stock market is worth over 1.6 trillion dollars. Additionally, in the last 20 years we’ve seen house prices sky rocket to 16x the average wage, vs 4x in the 80s.

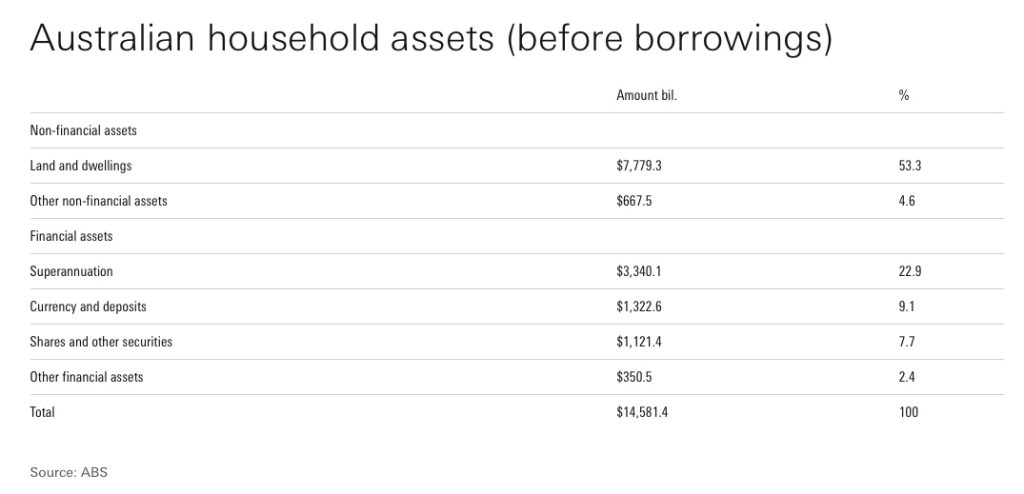

And if you look at property as percentage of household assets, the latest data from the Australian Bureau of Statistics shows that property makes up 53.3% of total household assets, the highest category by a large margin. Superannuation and cash are the next largest categories at 22.9% and 9.1%, with shares at a lowly 7.7% share of household assets.

If you saw these numbers alone with no additional context, you would assume that property must be the best place to put your money. But is this because it’s the best investment option for your hard earned cash? I think it’s safe to say there are a lot of reasons outside of investment returns as to why property is over 10 times more popular than shares.

In this post we’re going to focus specifically on real estate investing versus share investing, we’ll look at the historical investment returns of real estate vs stocks, the pros and cons of both methods, the effects of leverage, and finally at the end we’ll bring all of this information together to ultimately answer, what is the better investment, property or stocks?

Now to take a trip down memory lane, I’m sure a lot of us were told from a young age that we should go out and get a job, save a bunch of money for a house deposit and then pay off our mortgage as quickly as possible. This was definitely the case for myself but for whatever reason the thought of of owing hundreds of thousands or even millions to the bank wasn’t really how I wanted to live out my life so I decided to look at alternative methods towards financial independence. However that never stopped me from thinking if I had made the right decision or not, especially when you see how much house prices are increasing by every single year.

Australian real estate vs Australian shares investment performance

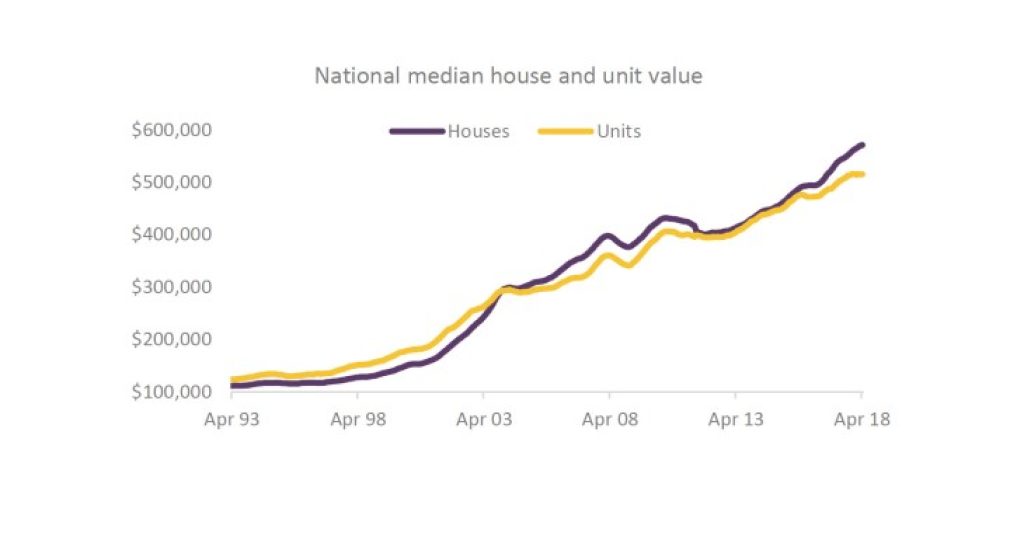

Now if we actually go and take a look at the historical returns of Australian property we can see in this report done by Aussie using data from CoreLogic, that median house values have increased by 412% over the last 25 years. This equates to a capital gain return of 6.8% per annum for houses and 5.9% per annum for units, which lets say for real estate in general regardless of dwelling type, the capital gain return has been somewhere in the middle at 6.4% per annum.

We also have to remember to take into account rental yields which when you use the median rental price and the median property price in Australia, comes out to 2.96% per annum.

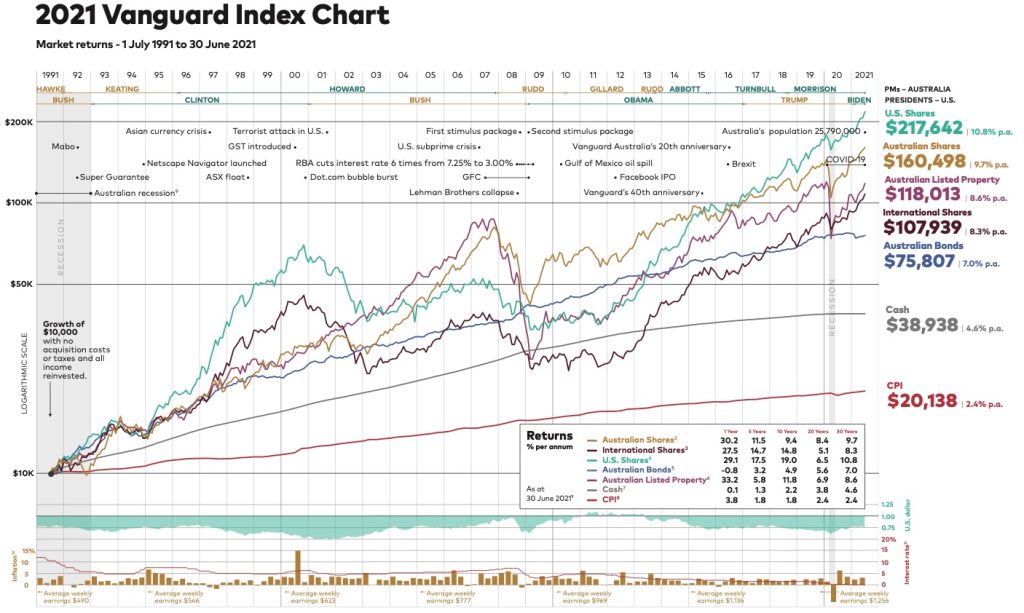

Which is really interesting once you compare it to the historical returns of the Australian stock market. In Vanguard Australia’s latest Index Chart, we see that the return of Australian Shares (dividends reinvested) has been 9.7% per annum over the last 30 years, so quite a bit higher than the property returns at first glance.

But this is of course not the full story, as with property there will generally be quite a lot of costs and time that you also need to dedicate towards ownership, whereas this isn’t the case with holding stocks. And on the flip side, most people will have quite a bit of leverage when acquiring property ie. get a home loan, which will further magnify the actual returns for real estate. Both of which I will consider and fully breakdown at the end of this post, in a real world example of the returns of real estate vs stocks.

Pros and Cons of Real Estate Investing vs Stock Market Investing

Pros and cons of real estate investing vs stock market investing

However before going into the numbers, I think its important to highlight all of the different pros and cons that are involved with investing in real estate or the stock market, so you have a super clear idea of what you’re getting into no matter what you choose.

Real estate vs stocks – pro and cons for investing

| Key points | Real estate | Stocks |

| Liquidity | Low | High |

| Diversification | Low | High |

| Leverage | High | Limited |

| Starting capital requirement | High | Low |

| Transaction and maintenance costs | High | Low |

| Ability to add value | High | Low |

Liquidity

Starting with liquidity. If you start investing into the stock market, you are holding investments which generally have a high level of liquidity, as long as you stay away from penny stocks. Shares and ETFs settle in T+2 (trade date + 2 days) – which just means when you sell your shares/ETFs, the proceeds will be available to withdraw in two business days. This is a significant advantage vs. property if something unexpected comes up and you need to access some or all of your cash. Compare this to the time it takes from deciding to sell an investment property, getting it ready, listing it, finding a buy, negotiating on a price, to when you finally receive the proceeds of the sale. Plus, if you don’t need all of your funds, you can’t just sell off a bedroom!

Stocks are definitely much more liquid than real estate and provide you with a lot more flexibility if you do need to access some or all of your capital in a pinch.

Diversification

Diversification is probably one of the largest differences between stocks and real estate. Whereas property investors typically invest in a very small number of assets, share investors can easily spread their money across a range of investments. ETFs make this even easier. By purchasing ETFs that are traded on the ASX, you can easily diversify your portfolio without having to buy multiple companies across multiple sectors and asset classes. ETFs give you the opportunity to buy a number of companies in one sector or across a broad market.

Additionally through using ETFs, you can also obtain exposure to other asset classes such as commodities, currencies – and even commercial and industrial property.

For example the most popular ETF on the ASX, the Vanguard Australian Shares ETF or VAS, give you the ability to invest in the 300 largest companies on the ASX through a single stock purchase.

On the flip-side with property, all of your cash is tied up with usually 1 or 2 properties and if you get unlucky with your choice, the returns could be much lower (or even negative).

Leverage

Now onto leverage. This is the big winner for investing in property. The most important figure for an investor is your return on investment (ROI). When you purchase a property, you usually borrow a substantial portion of the cost. Assuming you put down 20% of the value of the property, you are 80% leveraged, or you have a 80% loan to value ratio (LVR), therefore your future investment return will be a much larger percentage of the value you initially put down, than if you had paid the total value in cash.

Of course there is no reason you can’t gear your share portfolio to the same extent as a mortgage, using something like a margin loan. But hardly any stock market investors use leverage, whereas almost all property investors take advantage of borrowed money. This is partly because of the potential for margin calls, which you don’t get with property as your home isn’t marked to market on a daily basis, and partly because share investment loans are typically at a higher rate than property loans.

There’s actually a way to get the benefit of both low rates and no margin calls for share market investing if you own a property. This is by drawing down on any existing equity in your home loan, and using those funds for investing in the stock market.

Starting capital

For those of you at the start of your investing journey, one of the most important things is to obviously to actually get started. With shares this is pretty simple and you can get started with as little as $100 on most ASX broker platforms. However this is definitely not the case with property, where you will need at least 5% of the property value as a deposit, or 20% if you don’t want to be hit with LMI fees. And given the sky high property prices in most capital cities, even at 5% this can be a significant chunk of change, for example a 5% deposit on a $500,000 property is still $25,000.

Transactional costs and maintenance costs

Talking about costs, the transaction and maintenance costs associated with property and stocks could not be more different.

Transactional (upfront) costs of property vs. stocks

As a starting point, a typical share purchase will cost anywhere from $5 – $20 depending on your stock broker on the ASX.

Compare this with the costs associated with purchasing a property in Australia, well you have legal fees, stamp duty, inspection fees, mortgage registration fees, transfer fees and loan application fees, just to name a few. Stamp duty alone is around $8,000 on a $500,000 property in NSW.

On a property value of $500,000 – this would add up to around the following:

- Conveyancing and legal fees: $1800

- Stamp duty: $0 for first-home buyers, $8750 for others

- Building and pest inspection (combined): $600

- Mortgage registration fee: $187

- Transfer fee ($35 for every $10,000 over $180,000): $1120

- Loan application fee: $500 – $600

Maintenance (ongoing) costs of property vs. stocks

And then moving onto the ongoing costs, again shares have hardly any. If you’re holding individual company stocks there are essentially no ongoing costs, however if you are investing in ETFs or managed funds to access simplified diversification and portfolio management, then you will be subject to management costs, which can be anywhere from 0.1% for a passive index fund to over 1% for some expensive actively managed funds.

Property on the other hand has quite a lot of ongoing costs both in terms of time and actual dollars, which can range from things like: property maintenance, insurance, rates, property management fees and strata fees. I’ll be getting into these in detail shortly through a real world example of investing in property vs. stocks.

Ability to add value

Finally if you’re someone who wants to get their hands dirty and really have some input on their investment returns, then this is where something like property will be a good investment choice. As you are able to get a lot more hands on and magnify your investment returns through renovations, upgrades, and lobbying for things that might increase the overall location of your property.

With stock investing, this is a lot more difficult and unless you actually work at the company that you have stock holdings in, it will be near impossible to have any real influence on the stock price, and hence the investment returns.

Real estate vs stock market investing returns

Real world example of real estate investing vs stock market investing over 20 years

However, ultimately one of the deciding factors of choosing to invest in real estate or stocks will probably come down to the investment returns associated with them. And whilst we can’t predict the future, it is a really interesting exercise to compare historical returns of real estate investing and stock market market investing. As it at least gives us a good idea of what type of returns to expect and the costs that would be involved in either investment strategy, which were definitely pretty surprising.

For this real world example we’re going to imagine that we are going to buy an average property today and assume that the return is equal to the historical returns over a similar time period. And we will compare it to using that same money to instead invest in stocks, along with the additional stock investments equal to the mortgage repayments we are comparing against.

For this hypothetical comparison I used the following assumptions, which I have tried to use median or average values for everything I could.

Real estate investing assumptions

- Australian real estate 25 year return per annum: 6.40%

- Australian real estate median rental yield: 2.96% – calculated using the median rental price per week in Australia and the median property price, which are $476 a week and $835,700

- Average home loan interest rate in Australia over the past 20 years: 5.50%

- Assuming a 20% deposit on the median property price, means we would need to save a deposit of $167,140, which would give us a loan amount of $668,560

- Monthly repayments on a loan amount of $668,560 at 5.50% for 30 years would be $3,797 a month.

Real estate investing – cost assumptions

On an average priced property these are the ballpark costs you would have to expect to pay each year. For this example I have purposely ignored land tax, as I assumed you would be under the threshold. If you were eligible for paying land tax, the value would be just over $13,000 per year.

- The cost of your time dealing with various issues at: $500

- Maintenance and repair costs: $2,169

- Landlord insurance: $1,423.80

- Building insurance: $922

- Council rates: $1,662

- Property management fees (assuming 5.5%): $1,361.36

- Body corporate fee (have assumed a small amount to balance for houses which don’t have any strata fees): $1,000

- Total: $9,038.16

Now we can’t forget that with real estate investing, there are significant tax deduction which help offset the much higher costs. The average tax deductions for investment properties come out to $25,717 a year. Which for the purposes of simplifying this example, I have assumed will just cancel out the costs associated with property. In reality this will depend on your salary and what your marginal tax rate is.

Real estate investing returns

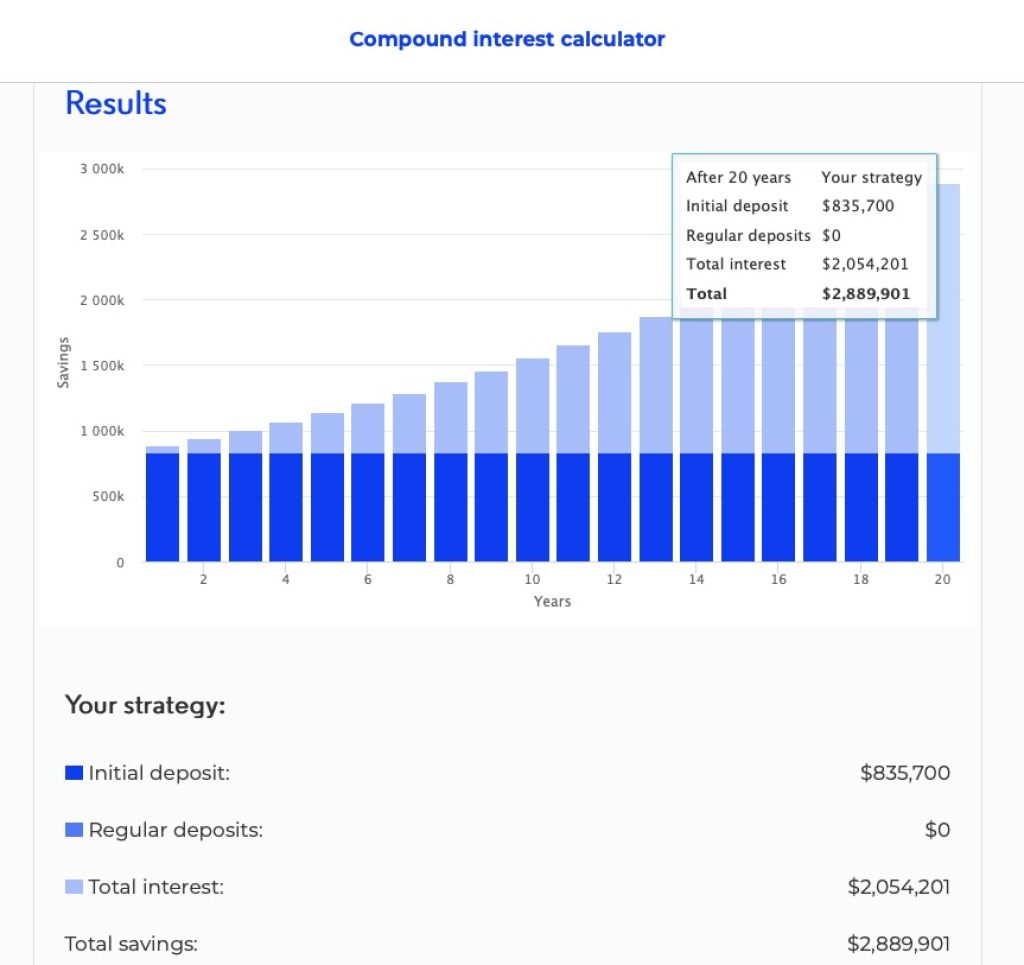

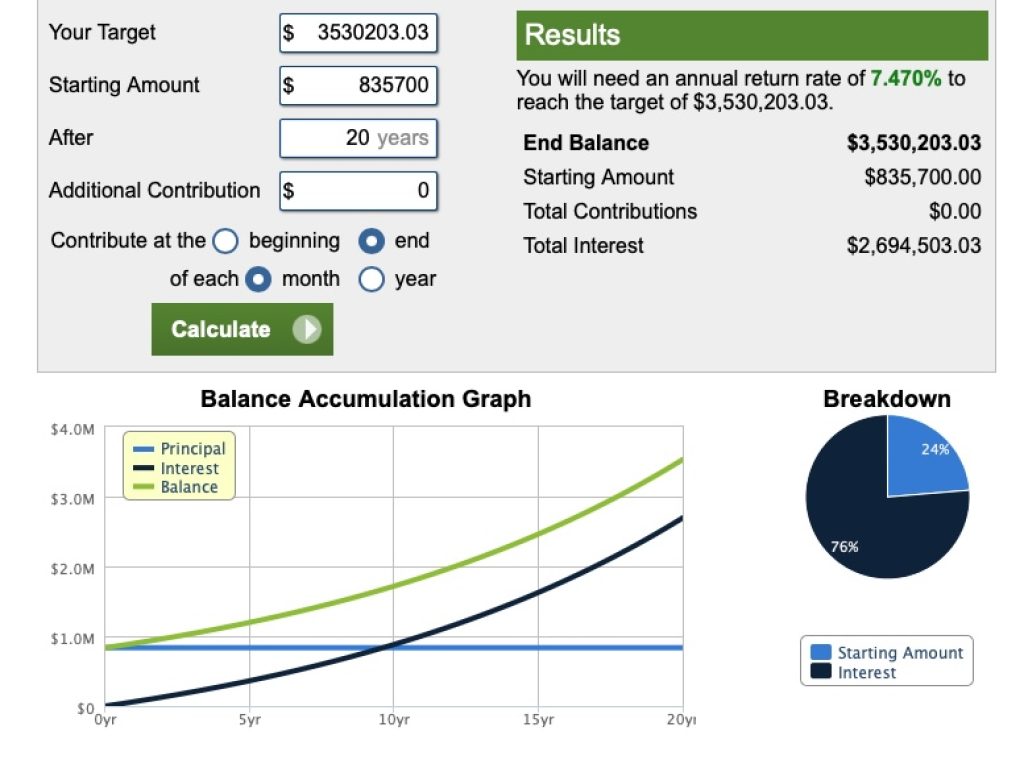

After 20 years at a return of 6.40% your $835,700 would be worth $2,889,901 and your rental income would have been $495,040, however for this example this is doubled to account for inflation and rent increases over time, which gives us $990,080. Lastly we still have a $349,777.97 loan balance remaining.

After adding the rental return to property value and subtracting the remaining loan balance, this leaves us with a total value after 20 years from investing in real estate of $3,530,203.03. This calculates to a return rate of 7.47% p.a.

Stock market investing returns

But now for the actual comparison, if we instead took our deposit of $167,140, plus the monthly mortgage repayments and used them to buy into Australian shares, at their historical return of 9.7% p.a (dividends reinvested) then we would after 20 years have $3,927,672.69, almost $400,000 more than if we invested in property, all without using any leverage.

So in the end it appears stock market investing has come out on top of real estate investing, especially if you aren’t really keen on getting your hands dirty to add additional value to your property over time.

What’s also super interesting is if you started investing the amounts you were saving for your home deposit straight away in the stock market from day 1 instead of waiting for the deposit value of $167,140. Then you would have actually ended up with $4,149,372.89, over $200,000 more. This is because you would have been able to start investing almost 4 years earlier, as that is how long it would have taken to save that deposit amount (assuming you are saving amounts equal to the mortgage repayments).

Keep in mind that these are all historical numbers and are not a guarantee of what will happen in the future.

Alternatives to Investing Directly Into Real Estate

Alternatives to real estate investing if you don’t want to own property directly

Before ending the post, I did want to provide a couple of ways to get exposure to the property sector without necessarily owning real estate directly if its something you really want to do.

- Invest in a REIT (Real estate investment trust)- REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and there’s a number of them available on the ASX. One of the most popular ones is the VAP ETF run by Vanguard.

- There are some newer business that offer fractional ownership of property, however they aren’t something I would consider at this point. As they typically miss out on a lot of the traditional benefits of real estate investing like cheap access to leverage.

Does this take into account the cost of rent while investing versus property ownership?