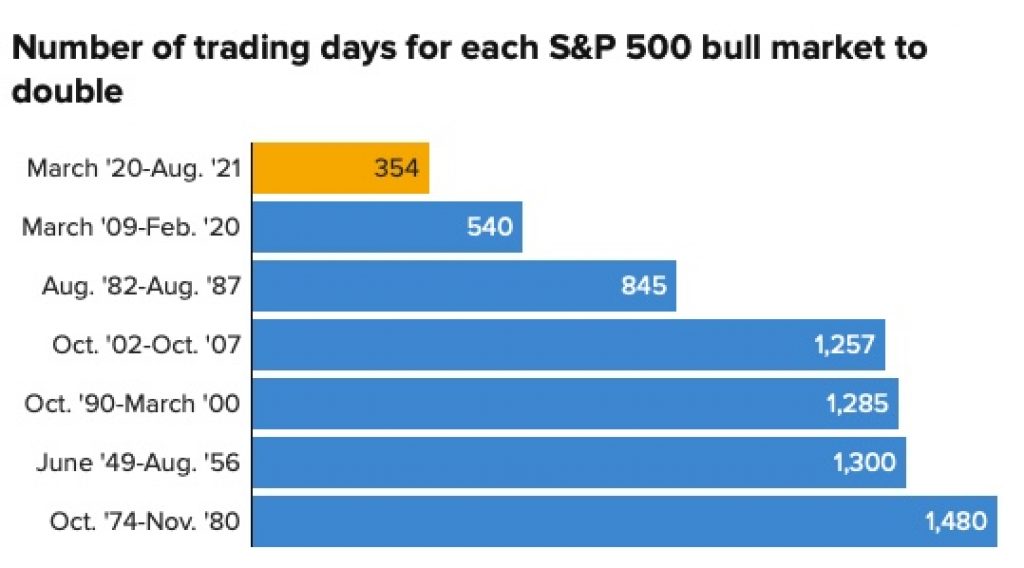

So these days if you tune into any finance news, all you’ll hear is how the market is hitting all time highs. Just this week the S&P 500 hit double the value from its pandemic closing low in March 2020, marking the FASTEST bull market rally since World War 2. It took the market only 354 trading days to double in price, with previous bull market rallies taking on average over 1,000 days to achieve the same result.

With passive index funds now controlling almost 50% of the assets in US domiciled equity funds, if there is indeed a bubble looming, it’s a massive deal. And as someone who invests through passively managed index funds I thought this was something definitely worth analyzing, to figure out if this is really a catastrophic bubble or just overblown hype.

And it’s not just the media, you have investors like Michael Burry who famously had predicted the US mortgage bubble that triggered the 2008 GFC, raising concerns and describing a “bubble” in the world of passive investing. Whereas on the flip side you have equally renowned investors like Warren Buffet, claiming that you should keep investing in passive index funds regardless of the current market conditions. With all this conflicting information and noise in the media, it’s hard to understand what is actually going on.

So in this post I’m not going to make any crazy predictions but instead unpack all the arguments on either side of the debate, whilst analysing the data to find out whether or not we’re actually in a bubble and what this actually means for those of us investing in index funds and ETFs.

Index fund introduction

What is an index fund?

Now to start with, an index fund is simply a way to invest a large collection of stocks all in one easy package. An index fund might have thousands of different individual stocks in it but you only have to make one purchase to own a portion of all of them. In a world without index funds, if you wanted to have say a thousand different stocks in your portfolio you’d have to make 1000 separate purchases. If you’re paying $10 per trade that would cost you $10,000 alone just buying the companies, on top of also taking you a lot of time!

Using an index fund is way simpler than trying to self-manage a portfolio of thousands of different companies, constantly trying to re-balance weightings every day. And the best feature of an index fund is in its name, it’s the fact that it passively tracks an index. An index is a set of “investment instructions” that the fund needs to abide by, for example an index fund that tracks the S&P 500 is tracking the performance of the 500 large companies listed on stock exchanges in the United States.

Through owning a lot of different stocks this gives you the other major benefit of these index funds, that is diversification. If you have 10 individual stocks in your stock portfolio and one of those goes down and fails, you can end up losing a lot of money. On the other hand if you go and buy the entire S&P 500 index fund, then you have 500 different stocks and companies that contribute to your overall return. So even if one of those fails it doesn’t really matter because you have 499 others to boost you up.

Popularity of index funds

Why have index funds become so popular?

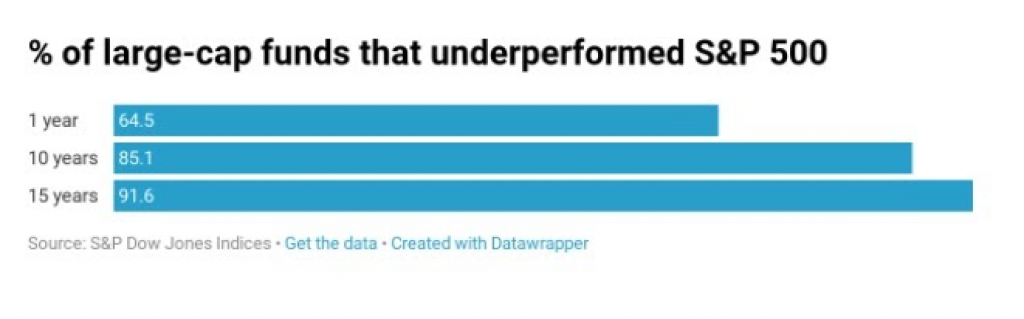

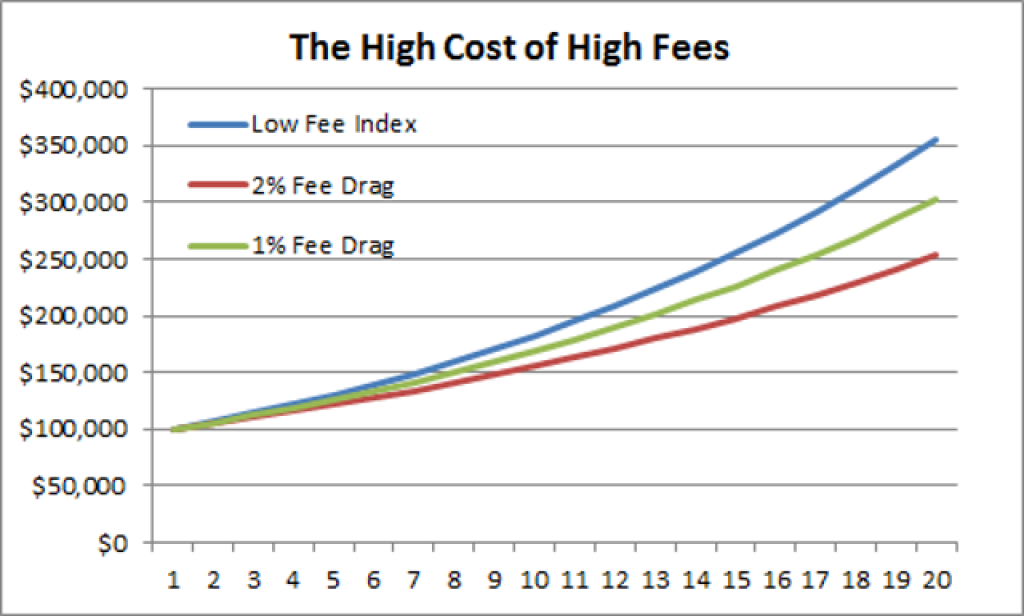

Passive investing through index funds has become hugely popular for a couple of main reasons in addition to the ones I just mentioned. Firstly they generally have very low fees, passive ETFs will usually charge fees less than 1% p.a, with the cheapest ones being sub 0.2% p.a. Secondly, over the long term they’ve shown to provide better returns than all but the very best active fund managers (we’re talking like only around the top 10% of fund managers that can consistently outperform a broad market index).

This is probably why you have investors like Warren Buffett saying that index funds make the best retirement sense “practically all the time”. Which kind of gets us to our point that if index funds are becoming so popular and being recommended left right and centre, is this potentially a problem, and does this mean there could be an index fund bubble?

Let’s dive into this.

Why there might be an index fund bubble

Index fund criticisms

This passive investing revolution has been awesome for those that have taken the plunge: They’ve gotten better returns for lower fees, as index funds shift billions of dollars away from the pockets of active fund managers back towards the average investor.

However what might be (and has been) good for the average investor might not necessarily be good for financial markets, public companies, or the global economy. As a result, we’ve definitely seen passive investing receive its fair share of criticism. Analysts at Bernstein have called passive investing “worse than Marxism.” The investor Michael Burry, of The Big Short, has called it a “bubble” comparing it to subprime CDOs. Shortly before his death in 2019, even the father of passive investing, Jack Bogle himself warned that index funds’ dominance might not “serve the national interest.”

Burry thinks all that money automatically flowing into passive funds means that no one is doing research or analysis on the fundamentals of companies to determine the true value of stocks. As he put it in his Bloomberg interview:

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

To Burry, not looking at individual stocks is like not looking at the individual loans that investment banks packaged up into the mortgaged-backed securities. Without that stock-by-stock analysis, he thinks prices aren’t reflecting their “true” value by being bought and sold on their own merits. Economists call this form of price determination through analysis and then buying and selling “price discovery”.

Index funds lack price discovery

So the primary concern of all the critics is that there is no price discovery occurring from investors using passive index funds. What does this mean? Well typically when an active fund manager invests into a company, they would perform in-depth research into the company itself, taking new information and pricing it into what they believe the company’s stock price should be, to determine whether it makes sense to purchase shares in the company or not.

On the other hand we have passive investors, who don’t do any research, don’t read any annual reports, or listen to market rumors. Making no attempt to find out if the stock price of a company reflects its real value. Leading the critics like Burry to say that index funds are causing companies inside these passive funds to be priced inefficiently and as a result are overvalued.

This is definitely a fair concern but is only a problem if all the money in index funds is actually affecting the stock price.

The effect of index funds on stock prices

In a paper published by Vanguard in 2018, Vanguard showed that on average, 94% of equity ETF trading happens on the secondary market, where ETF unit holders are buying and selling from each other without touching the underlying securities. And the only reason why the underlying securities with an ETF would need to be traded (causing a change in the price), would be when there are differences between the ETF’s price and the value of the companies within the fund.

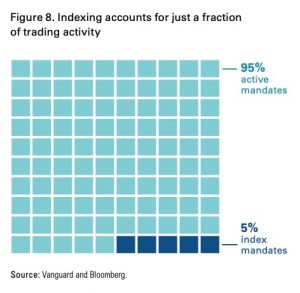

Of all trading activity in the stock market, passive index funds are only responsible for about 5% of it, whilst active trading from fund managers and retail investors make up the rest of it. Since we know that stock prices are determined by trading, this shows that index funds have a small overall impact on the actual prices of the companies they are investing in, despite their large sizes.

Even if you took this to the extreme case, in a world where index funds were heavily affecting stock prices, this would create serious opportunities for active traders to come to the table and make large profits. Since active traders and investors always go where the best opportunities are, any price distortion from passive investing would be quickly identified and ultimately balanced out.

What is the definition of a bubble?

Index fund bubble definition

Now knowing all of this information, I wanted to actually look up the definition of a bubble to see if the popularity of index funds meet the criteria. Economist Hyman P. Minsky was one of the first to explore the development of financial instability and outlined the 5 stages of a bubble.

5 stages of a bubble

- Displacement: A displacement occurs when investors get enamored by a new paradigm, such as an innovative new technology.

- Boom: Prices rise slowly at first, following a displacement, but then gain momentum as more and more participants enter the market, setting the stage for the boom phase. During this phase, the asset in question attracts widespread media coverage. FOMO spurs even more speculation, drawing an increasing number of investors and traders into the fold.

- Euphoria: During this phase, caution is thrown to the wind, as asset prices skyrocket. Valuations reach extreme levels during this phase as new valuation measures and metrics are touted to justify the relentless rise. When you hear your mum and dad tell you about how they are investing in bitcoin, you know you’ve reached this state.

- Profit-taking: In this phase, the smart money recognises the bubble is about at its bursting point and starts selling positions and taking profits.

- Panic: In the panic stage, asset prices reverse course and descend as rapidly as they had ascended. This is usually triggered by some external event in combination with the profit-taking that has been occurring in the background. As supply overwhelms demand, asset prices slide sharply.

Now stepping through these in reverse, we definitely aren’t in a panic or profit-taking stage, since we know that the market has recently hit all time highs. There is an argument for Euphoria/Boom, however it can’t be attributed to index funds themselves, as we know they have little effect on underlying stock prices. Given that the first index fund was created in 1975, they definitely aren’t new being almost 50 years old, but I guess we can say that they are recently getting much more popular, so perhaps there is some displacement happening.

Conclusion

Is there an index fund bubble?

So given all of this, I personally don’t think that index funds meet the criteria of a bubble, even with passive investing participation and the market itself at all time highs. Whilst there will always be booms and corrections in the overall stock market, the market valuations aren’t really affected by index funds, and we will continue to see passive investing and active trading balance each other out.

I will continue to hold the course and invest in regular intervals regardless of the current market conditions, as it’s really hard to try and time the market, and attempting to, will probably lead to emotional trading and subpar returns.