The idea of a three fund or two fund portfolio (The Lazy Portfolio), is simply just a very popular low-maintenance way to structure an investment portfolio whether it’s for a superannuation account or for your own personal investing.

So in this post we’re actually going to talk about what the two fund portfolio is at a conceptual level, the benefits of a two fund portfolio, how to actually build the Vanguard version, some alternative two fund portfolios to consider (which are actually really quite good) and then finally be sure to stick to the end where I’ll share a really easy way to actually stick to your target allocation percentages for the portfolio.

The two fund portfolio

What is a 2 fund portfolio?

Now remember when I said I’ll explain why we’re talking about the two fund portfolio here and not the three fund portfolio, well to do that I have to first share with you the three fund portfolio which was the original holy grail portfolio of passive investors, the OG.

So very simply, the original three fund portfolio comprises of three different asset classes, you have US stocks, US bonds and international stocks, and the Australian version of this is Australian stocks and bonds, plus international stocks. The concept of the three fund portfolio was popularised by “Bogleheads”, a group of investors named after the original founder of Vanguard and the grandfather of passive investing, Jack Bogle. Now this doesn’t mean you can go out and buy any Australian stock, Australian bond, and international stock, and say that you have a 3 fund portfolio. Well.. actually you can, and technically you would be correct, but that isn’t the point here.

The point is to achieve a highly diversified portfolio using low cost index funds or ETFs. If you’re not sure what an index fund is, it’s a way to buy a whole basket of stocks through a single transaction, imagine if you wanted to buy the largest 500 companies in the world, it would be pretty cool if you could do that by just buying a single stock, rather than all 500 individually, well that’s what an index fund or ETF allows you to do.

So back to the two fund portfolio, well this is just a version of the three fund portfolio but without the bond allocation. And the Australian version would comprise of an Australian Shares index fund and an International Shares Index Fund. Now you might be wondering to yourself, is the two fund portfolio actually better than the three fund portfolio and is it really better to drop bond allocation from your portfolio altogether? Well, the answer is, like most things in life, it depends on your situation. In general, if you prefer higher growth with a bit of extra added volatility, then the two fund portfolio is probably a better fit. It’s also a bit simpler to manage and keep balanced, having one less fund to worry about.

And there’s one more reason why it might make sense to drop bonds from your long term investment portfolio. Just this year in his 2021 annual Berkshire Hathaway shareholder letter, the legendary Warren Buffet warned that debt investors faced a “bleak future” days after a sell-off pummelled government bonds.

In the annual letter, he shared that it was best to avoid the fixed-income market, in which the company is itself a large player. “Fixed-income investors worldwide — whether pension funds, insurance companies or retirees — face a bleak future,” he wrote. “Competitors, for both regulatory and credit-rating reasons, must focus on bonds. And bonds are not the place to be these days.”

Basically saying, that whilst large fund managers are forced to invest in bonds, due to regulatory requirements, they will most likely have very poor returns compared to the past and aren’t optimal for long term retail investors.

Benefits

The benefits of a 2 fund portfolio

Performance

Now moving onto the benefits of a simple two fund portfolio. When most investors are picking individual stocks and talking about their crazy gains they got on gamestop or bitcoin (whilst also failing to mention their losses), it’s not very “exciting” to talk about investing in just 2 index funds, but there’s a really good and profitable reason to.

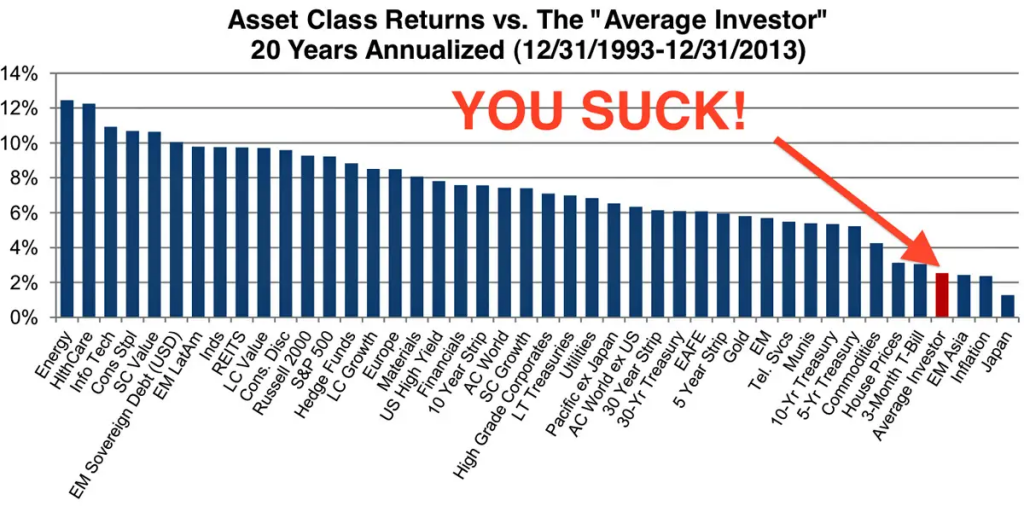

Historically they’ve outperformed actively managed funds where investors are going in and buying and selling individual stocks, which means more money and more profit for you. In fact several studies have suggested that over 90% of professional portfolio managers could not outperform the market index over a 15-year period. Pretty interesting to look at the stats here, as you just keep increasing the time horizon, more and more fund managers get worse returns than the market index, showing that the vast majority of active traders can only ever beat the market over the short term.

And then you have to keep in mind a lot of those managers are Ivy League college graduates with a really deep understanding of economics and finance who are the brightest in their fields who do this full-time and not even they can outperform a broad index fund long term. If you compare this to the returns of the average punter, well, it ain’t pretty. At just over 2% versus the SP500 at over 8% over a 20 year period.

Simple and easy, More likely to keep balanced

So hopefully you’re now convinced that the returns of a simple two fund portfolio are probably going to be better than what you will get by trying to pick your own stocks. Which leads us to the next main benefit, which is that a two fund portfolio is simple.

Why is simplicity a benefit? Well basically, the more funds or stocks you have in a portfolio, the harder it is to keep it balanced to your target allocations. ETFs and Index Funds already make this a LOT easier but once you start having a few of these in your portfolio, the differing price fluctuations make it harder to keep them balanced. If you only have two funds to worry about, it’s much more likely you will keep it balanced to whatever your target allocation is, and you’re also not having to check the prices of a million different stocks, making them much easier to monitor.

Low cost

The third main benefit of the two fund portfolio is that it will save you a lot of money over the long term. Because if you’re using low cost index funds for your two fund portfolio (of which I’ll share the Vanguard two fund portfolio shortly, as well as some alternatives), then your management fees will be very low for the amount of diversification you can obtain. On top of that, in a stock market like Australia, where we still need to pay for brokerage, if you only ever need to buy two stocks, you’ll be able to save on brokerage costs, which will add up over time as well.

The Vanguard two fund portfolio for Australians

The Vanguard version of the Australian two fund portfolio and the shares that are actually inside of it

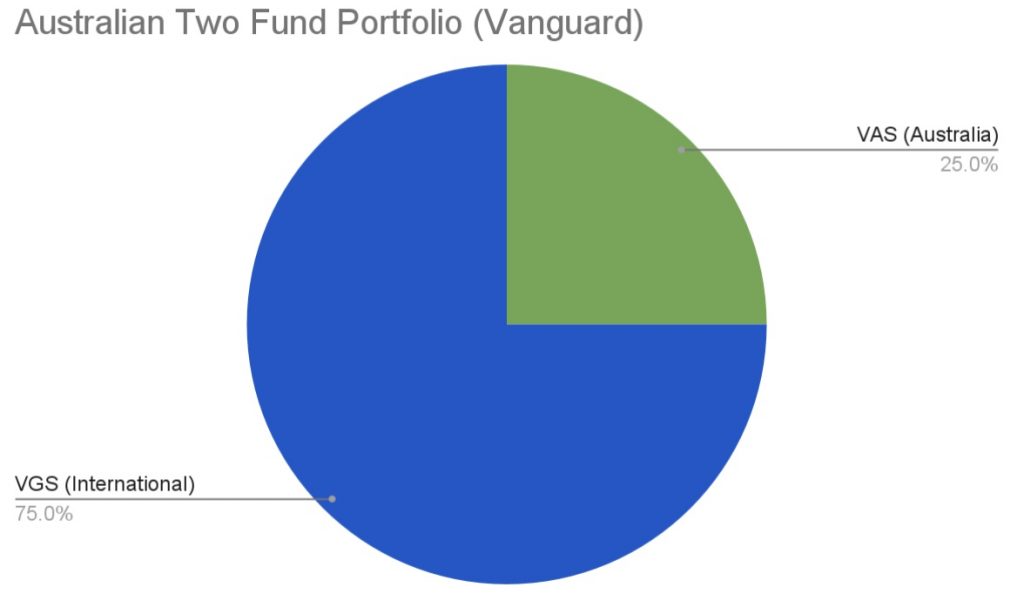

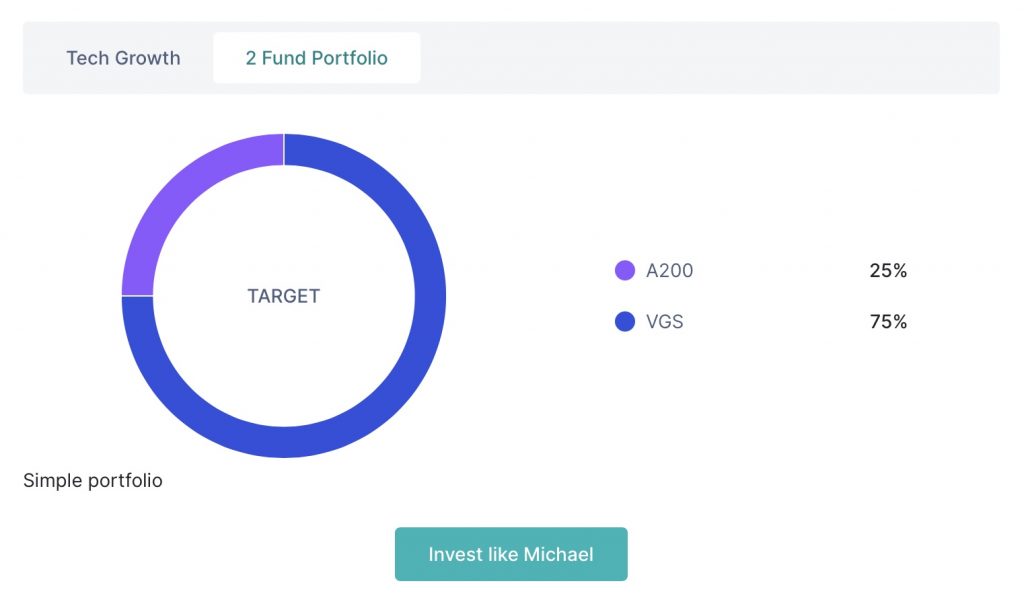

Now onto how you can actually build your two fund portfolio in Australia. Well the most popular and foolproof way is to use Vanguard Index Funds or ETFs, namely the Vanguard Australia Shares Fund (VAS) and the Vanguard International Shares Fund (VGS). This comprises of 75% International and 25% Australian, giving you decent exposure to Australian companies and their sweet franking credits, as well as exposure to the rest of the world, and there’s no overlap as VGS doesn’t include Australian holdings.

With this combination you’ll have global diversification across 1,800 different companies, only missing companies from emerging markets and small caps.

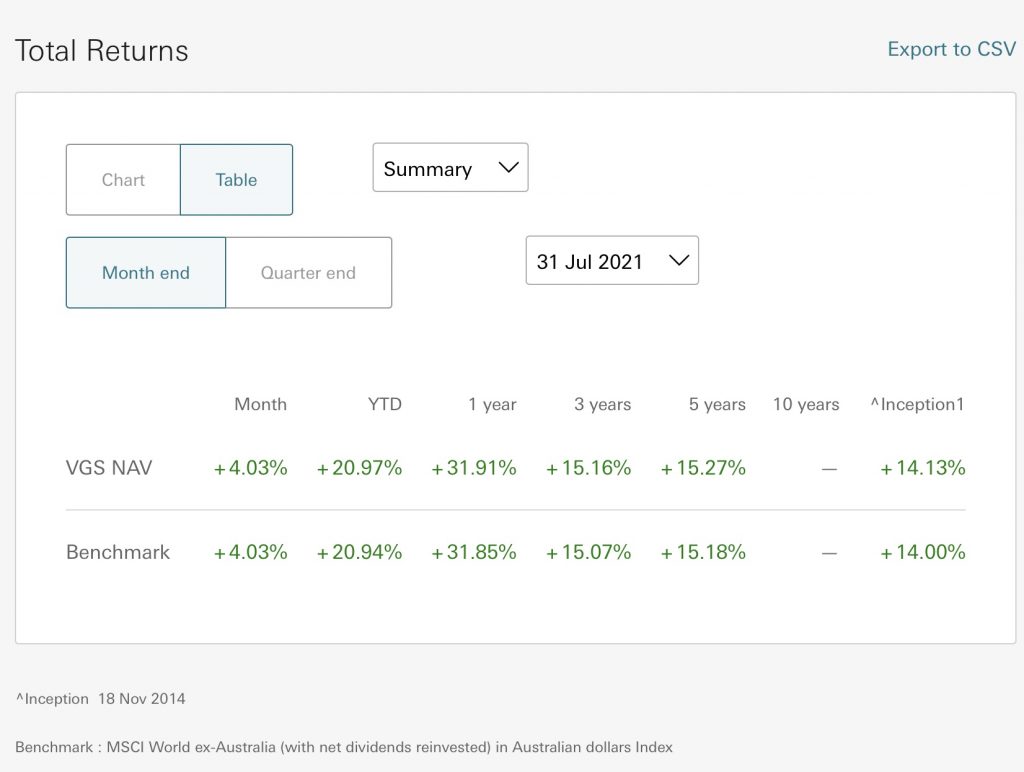

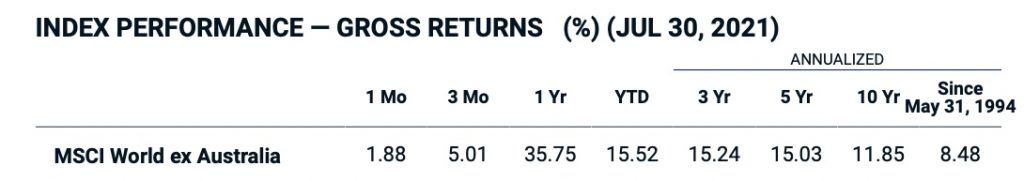

VGS provides exposure to many of the world’s largest companies listed in major developed countries. It offers low-cost access to a broadly diversified range of securities that allows investors to participate in the long-term growth potential of international economies outside Australia. It has returned over 14% p.a since inception in 2014, with top holdings being household names like Apple, Microsoft and Amazon.

However important to note, that the long term historical return of the actual index it is tracking, is closer to 9% p.a since 1994, since the VGS ETF has only been around since 2014, the since inception return is a bit skewed.

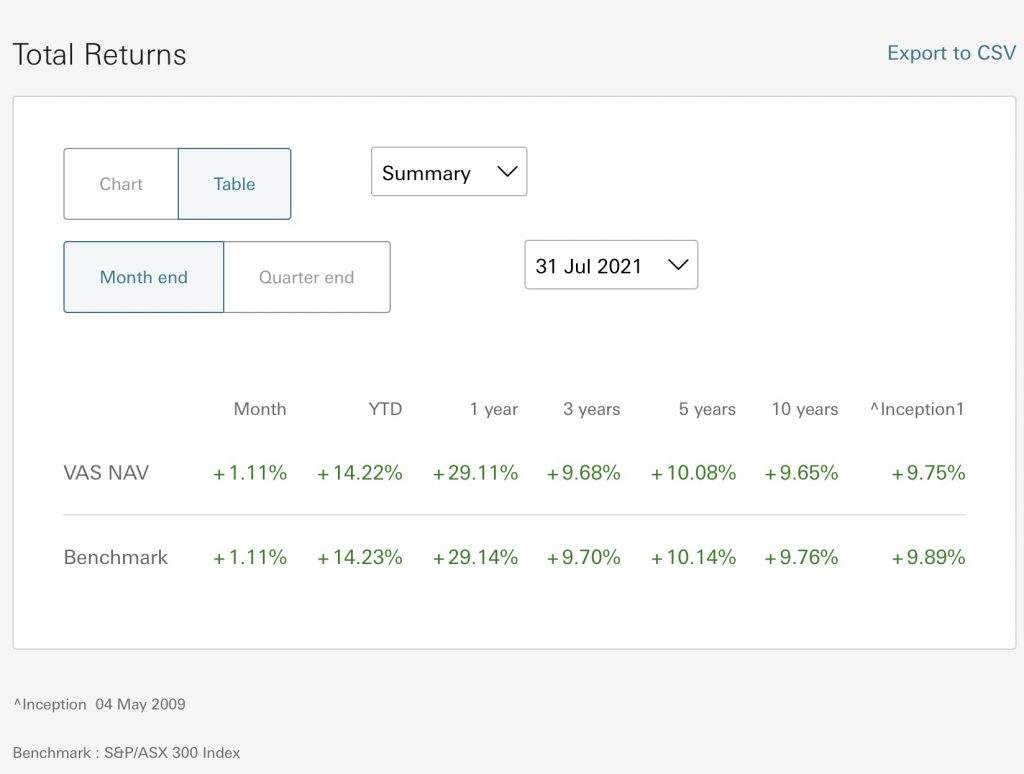

VAS holds the largest 300 companies by market cap in Australia and since inception in 2009 has has returned of over 9% p.a with the top holdings being the big 4 aussie banks, BHP and CSL.

The Vanguard two fund portfolio is great because it has super low management fees, VGS having a fee of 0.18% p.a and VAS with a fee of 0.10% p.a, with great diversification, all from a really reputable company with a long track record.

Vanguard ETF Alternatives

I’ll provide some alternatives options to the Vanguard 2 fund portfolio

Now if you want some spice in your life and are up for trying a two fund portfolio that isn’t restricted to Vanguard, well there are actually some really good alternatives with lower fees.

Swap VAS for A200

First alternative is to swap out VAS for A200, A200 is from BetaShares and holds the largest 200 companies in Australia rather than the top 300 of VAS. And it has an extremely low management fee of 0.07% p.a compared to the 0.10% of VAS. If you want to absolutely optimise the portfolio and pay the minimum amount of fees, this is an alternative I’d consider looking into, as the performance will be virtually identical but the small fee saving will add up over the long term.

Swap VGS for IVV

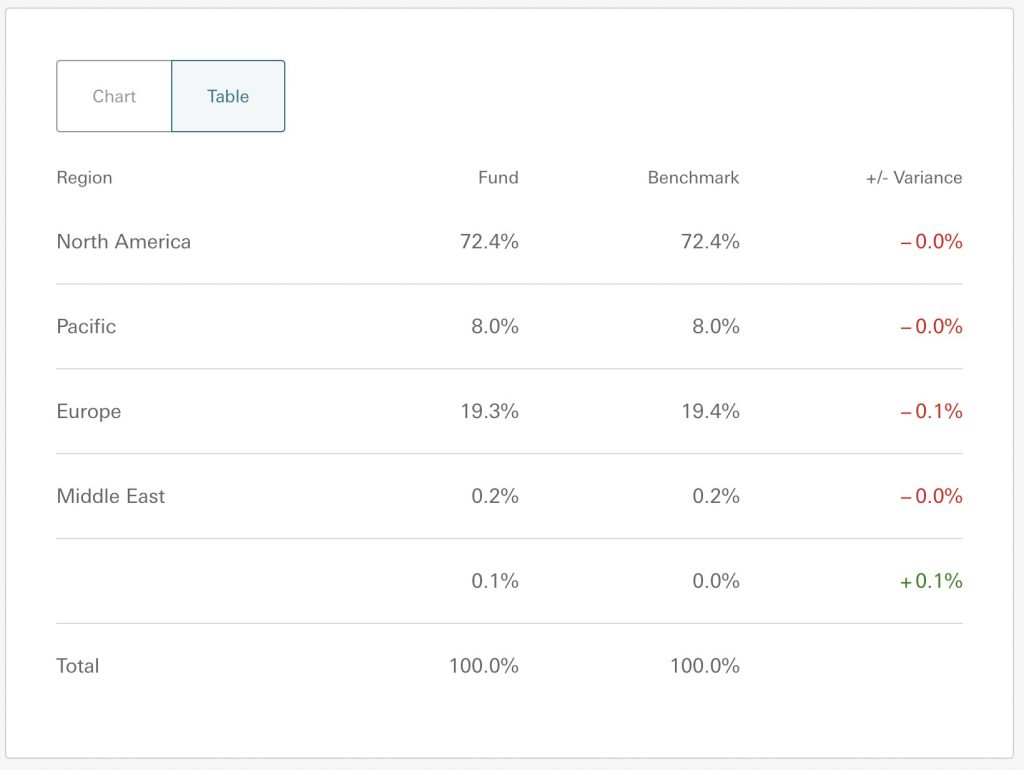

The second alternative to consider is swapping out VGS for IVV, IVV is an ETF that tracks the S&P 500 Index, which is the largest 500 US stocks. Now this isn’t as simple as the VAS for A200 swap, as IVV is obviously a lot less diversified compared to VGS. But the reason why I think it’s worth considering is because the US makes up over 72% of the exposure of VGS in the first place, and then more importantly, the management fee of IVV is incredibly low at 0.04% p.a. With the average return of the S&P 500 being over 10% since 1926, it’s comparable to VGS (that only has records going back to 2014. Again, this isn’t as straightforward, but definitely worth considering if you’re fee conscious and don’t mind a bit of extra exposure to the US.

Automatically balance your portfolio

Automate your target portfolio allocation balancing

Now, remember when I said most investors struggle with keeping their portfolio balanced to the target allocations, especially when there’s a lot of stocks to keep track of? Well there’s now a really simple way to automate this entire process and put your investing on autopilot.

That’s by using Pearler which is an investing platform available in Australia that has this really unique Autoinvest feature, that allows you to configure predefined investment instructions to automate your investing, much like how an ETF has to follow an index’s investment instructions. So you can basically tell it to invest in VAS 25% and VGS 75%, set up your deposit schedule, and it will take care of the rest.

If you want to check out Pearler, sign up using my link where you’ll get a brokerage FREE trade for signing up. In addition, check out my comprehensive review on Pearler if you want to learn more about Pearler and it’s features before diving in. Finally here is a link to my public profile on Pearler, where you can follow me.

Hi Michael,

Great article, wish I came across this before putting some coin in VDHG though it’s not a big deal as I’ve only just begun.

Regarding management fee, 0.07% and 0.18% from A200 and VGS means 0.125% total management fee (avg of 2) vs. 0.27% from VDHG – is my math right? I think it’s simple and obvious but just wanted to make sure.

Thanks!

Hey Tree – yes your calculation is correct! Wouldn’t stress too much, VDHG is still a good investment for the long run and like you said you’ve only just begun anyways.